Martingale is a betting strategy where you double your stake after every loss, aiming to recover previous losses with a single win. It carries significant risk, especially if a losing streak continues, potentially leading to substantial financial loss. Discover how the Martingale system works and whether it suits your betting style by reading the full article.

Table of Comparison

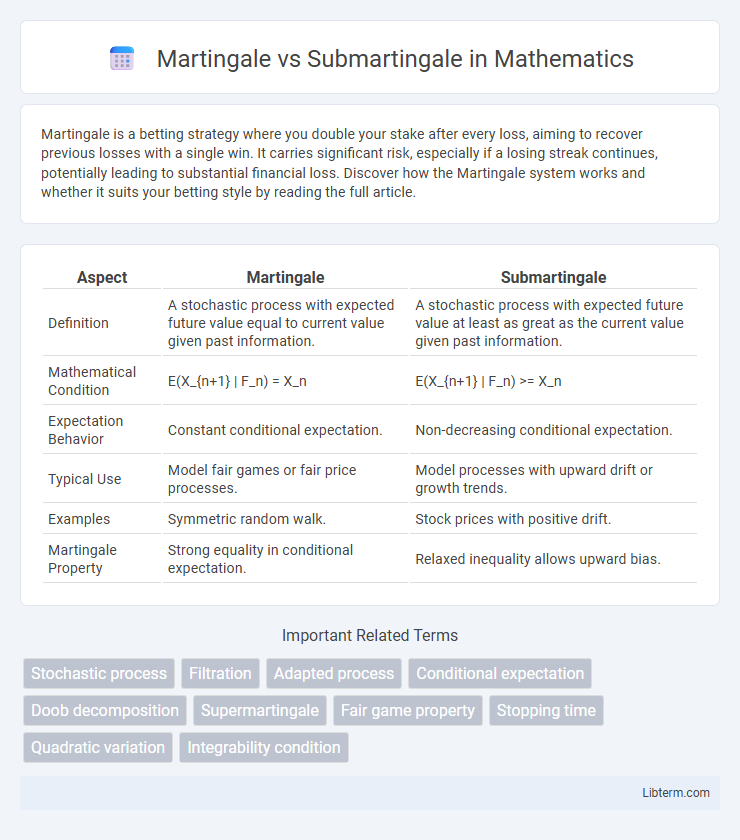

| Aspect | Martingale | Submartingale |

|---|---|---|

| Definition | A stochastic process with expected future value equal to current value given past information. | A stochastic process with expected future value at least as great as the current value given past information. |

| Mathematical Condition | E(X_{n+1} | F_n) = X_n | E(X_{n+1} | F_n) >= X_n |

| Expectation Behavior | Constant conditional expectation. | Non-decreasing conditional expectation. |

| Typical Use | Model fair games or fair price processes. | Model processes with upward drift or growth trends. |

| Examples | Symmetric random walk. | Stock prices with positive drift. |

| Martingale Property | Strong equality in conditional expectation. | Relaxed inequality allows upward bias. |

Introduction to Martingale and Submartingale

A Martingale is a stochastic process where the conditional expected value of the next observation, given all past observations, equals the present observation, reflecting a "fair game" with no inherent drift. In contrast, a Submartingale allows the conditional expected value of the next observation to be at least as large as the present observation, implying a non-negative drift or tendency to increase over time. These concepts are fundamental in probability theory and are widely applied in finance, gambling models, and stochastic analysis.

Fundamental Definitions

A Martingale is a stochastic process where the conditional expectation of the next value, given all prior values, equals the current value, embodying a "fair game" without predictable trends. A Submartingale is a related process where the conditional expectation is at least the current value, indicating a nondecreasing trend or potential gain over time. These fundamental definitions are crucial in the study of stochastic processes, financial modeling, and probability theory.

Key Properties and Differences

Martingales exhibit the property that their expected future value, given all prior information, equals the present value, making them models of "fair games." Submartingales, in contrast, have expected future values at least as large as the present value, indicating a tendency to increase over time. Key differences include Martingales' zero drift with no predictable trend, whereas Submartingales incorporate a non-negative drift, reflecting inherent growth or positive trend in stochastic processes.

Mathematical Formulation

A Martingale is a stochastic process \((X_n)_{n \geq 0}\) satisfying the condition \(\mathbb{E}[X_{n+1} \mid \mathcal{F}_n] = X_n\) almost surely, where \(\mathcal{F}_n\) is the filtration up to time \(n\). In contrast, a Submartingale fulfills \(\mathbb{E}[X_{n+1} \mid \mathcal{F}_n] \geq X_n\) almost surely, representing a process with a non-decreasing conditional expectation. These definitions are crucial in stochastic analysis, with Martingales modeling fair games and Submartingales capturing processes exhibiting expected growth or positive drift.

Examples in Probability Theory

A Martingale example in probability theory is the fair game of a gambler's fortune where the expected future value equals the current value, such as the game of fair coin toss betting. In contrast, a Submartingale example is the cumulative gains of a stock price modeled as a non-decreasing stochastic process where the expected future value is at least the current value, reflecting a trend. Both concepts are fundamental in stochastic processes, with Martingales representing "fair games" and Submartingales modeling scenarios with a positive drift or trend.

Applications in Finance

Martingale and submartingale processes are fundamental in financial modeling, particularly in the pricing of derivatives and risk management strategies. Martingales represent fair games with no expected gain or loss, essential for the efficient market hypothesis and modeling fair price evolution in arbitrage-free markets. Submartingales model scenarios with non-decreasing expected value, useful for capturing assets with positive drift, such as stock prices under risk-neutral measures in option pricing frameworks.

Role in Stochastic Processes

Martingales represent stochastic processes with conditional expected values equal to the present value, ensuring no systematic gain or loss over time. Submartingales model processes where the conditional expectation is at least the current value, often reflecting trends of growth or accumulation. These properties are critical in financial modeling, risk assessment, and the theory of stochastic integration.

Advantages and Limitations

Martingale processes offer the advantage of modeling fair games where the expected future value equals the current value, making them essential in financial mathematics for pricing and hedging derivative securities without arbitrage opportunities. Submartingales provide a broader framework by allowing the expected value to increase over time, which is useful in modeling scenarios with inherent growth or positive drift, such as stock prices with upward trends. Limitations of martingales include their restrictiveness to fair or zero-drift processes, making them less applicable to real-world phenomena with trends, while submartingales may be more complex to analyze due to their non-constant conditional expectations and potential for unbounded growth.

Martingale vs Submartingale: Use Cases

Martingales are primarily used in fair game scenarios and financial modeling to represent processes with no expected gain or loss over time, ensuring the best prediction of future values is the current value. Submartingales apply to situations involving positive expected growth, such as modeling stock prices with upward trends or gambling strategies where the odds improve over time. Understanding these distinctions helps analysts choose martingales for risk-neutral models and submartingales for scenarios involving expected gains.

Conclusion and Further Reading

Martingale processes maintain a conditional expected value equal to the current state, while submartingales exhibit a non-decreasing conditional expectation, indicating potential growth over time. Understanding these distinctions is crucial in fields like financial modeling, risk assessment, and stochastic calculus. For further reading, consult works such as "Probability with Martingales" by David Williams and "Stochastic Processes" by Richard Durrett, which provide comprehensive insights into martingale theory and its applications.

Martingale Infographic

libterm.com

libterm.com