The budget session is a crucial period when the government presents its financial plan for the upcoming fiscal year, outlining revenue, expenditure, and policy priorities. It significantly impacts the economy, businesses, and individual taxpayers by setting tax rates, subsidies, and spending on public services. Explore the rest of the article to understand how the budget session affects Your finances and economic landscape.

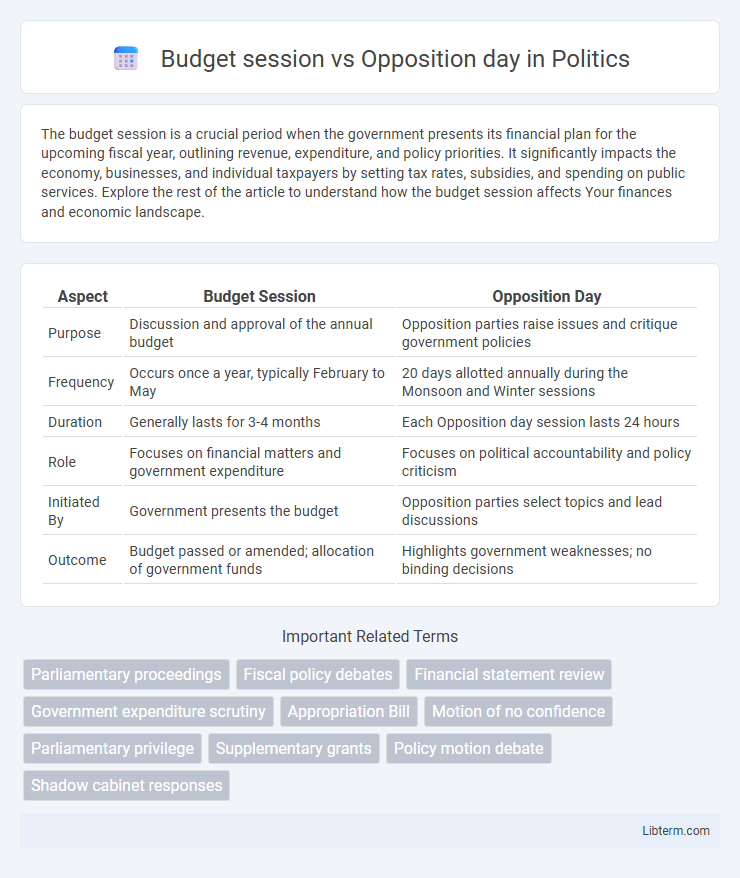

Table of Comparison

| Aspect | Budget Session | Opposition Day |

|---|---|---|

| Purpose | Discussion and approval of the annual budget | Opposition parties raise issues and critique government policies |

| Frequency | Occurs once a year, typically February to May | 20 days allotted annually during the Monsoon and Winter sessions |

| Duration | Generally lasts for 3-4 months | Each Opposition day session lasts 24 hours |

| Role | Focuses on financial matters and government expenditure | Focuses on political accountability and policy criticism |

| Initiated By | Government presents the budget | Opposition parties select topics and lead discussions |

| Outcome | Budget passed or amended; allocation of government funds | Highlights government weaknesses; no binding decisions |

Introduction to Budget Session and Opposition Day

The Budget Session is a critical parliamentary period dedicated to presenting and discussing the government's budget, outlining financial policies, revenue, and expenditure plans for the upcoming fiscal year. Opposition Day, typically fixed by the opposition parties, provides a platform to raise issues and scrutinize government policies, ensuring democratic accountability. Both sessions play distinct roles in legislative processes, balancing government proposals with opposition scrutiny.

Historical Background of Budget Sessions

The Budget Session of Parliament in India originated during British rule as a mechanism to allocate colonial revenues and has evolved to become an annual event for presenting the Union Budget, reflecting the government's financial plans and priorities. This session typically spans from February to May, allowing for detailed scrutiny and approval of expenditure and taxation proposals. In contrast, Opposition Days were introduced post-independence, providing the opposition parties designated days to set the agenda and raise issues of national importance, distinct from the government-controlled budgetary discussions.

The Origin and Evolution of Opposition Days

Opposition Days originated in the UK Parliament in the 1930s, established to allow the opposition parties to steer parliamentary debate independently of the government's legislative agenda. These days evolved as a formal mechanism for holding the government accountable by debating issues raised by opposition parties, distinct from the government's Budget session focused on financial matters. Over time, Opposition Days have become critical in democratic systems for ensuring diverse political voices and scrutinizing government policies beyond fiscal discussions.

Purpose and Significance of Budget Sessions

Budget sessions primarily focus on the allocation of government finances, allowing the presentation, discussion, and approval of the annual budget to ensure proper funding for public services and development projects. Opposition Day sessions provide a platform for the opposition parties to raise issues and hold the government accountable, promoting democratic debate and transparency. The significance of Budget Sessions lies in their role in financial planning and economic governance, directly impacting national policy and fiscal management.

Key Objectives of Opposition Days

Opposition Days primarily serve to hold the government accountable by allowing opposition parties to debate and raise issues that concern the public, which may not be addressed during regular sessions. These days provide a platform for scrutinizing government policies, pressing for transparency, and influencing legislative priorities without introducing financial bills, unlike Budget Sessions. The key objectives include highlighting governance failures, proposing alternatives, and mobilizing public opinion through focused parliamentary debates.

Major Procedural Differences

The Budget Session primarily focuses on the presentation and discussion of the government's budget, involving detailed financial scrutiny, while Opposition Day is allocated for opposition parties to raise issues and critique government policies on topics of their choice. During the Budget Session, the Lok Sabha discusses demand for grants and the Finance Bill, whereas Opposition Day provides no specific agenda and allows opposition members to set priorities to highlight grievances. Procedurally, the Budget Session follows a fixed schedule aligned with financial laws, contrasting with the flexible, debate-centered format of Opposition Day.

Impact on Legislative Processes

The Budget session primarily drives the legislative agenda by facilitating the approval of financial proposals essential for government functioning, thereby directly influencing fiscal policy and economic planning. Opposition Day serves as a critical platform for non-government parties to highlight issues, challenge government decisions, and hold the executive accountable, which strengthens democratic debate and transparency in lawmaking. Both sessions collectively enhance the legislative process by balancing government priorities with opposition scrutiny, ensuring comprehensive deliberation on policies.

Role of Government and Opposition Parties

The Budget Session primarily allows the government to present and seek approval for the annual financial plan, detailing revenue and expenditure proposals essential for national development and economic management. Opposition parties play a critical role by scrutinizing government policies, raising questions, and debating fiscal priorities to hold the executive accountable. Opposition Day sessions provide a platform exclusively for opposition parties to highlight public issues and challenge government performance, ensuring a balanced parliamentary discourse.

Common Debates and Issues Highlighted

Budget Session and Opposition Day both serve as critical platforms in parliamentary proceedings to scrutinize government policies and address public concerns. Common debates during these sessions often focus on economic strategies, allocation of resources, inflation control, unemployment, and social welfare programs. Key issues highlighted include fiscal management, transparency in governance, policy effectiveness, and accountability of government departments.

Comparative Analysis: Effectiveness and Challenges

The Budget Session primarily focuses on presenting and discussing the government's financial proposals, ensuring detailed scrutiny of fiscal policies and appropriation bills, which directly impact economic planning and governance. Opposition Day allows opposition parties to raise issues and hold the government accountable without debating budgetary allocations, providing a platform to highlight alternative policy perspectives but often facing limitations in influencing legislative outcomes. While the Budget Session demands extensive preparation and expert negotiation to address complex economic matters, Opposition Day challenges include limited time and political consensus, affecting its overall effectiveness in shaping governance.

Budget session Infographic

libterm.com

libterm.com