A financial audit provides an independent evaluation of an organization's financial statements, ensuring accuracy and compliance with accounting standards. This process helps identify risks, prevent fraud, and improve internal controls, thereby fostering trust among stakeholders. Discover how a financial audit can safeguard your business and enhance financial transparency by reading the full article.

Table of Comparison

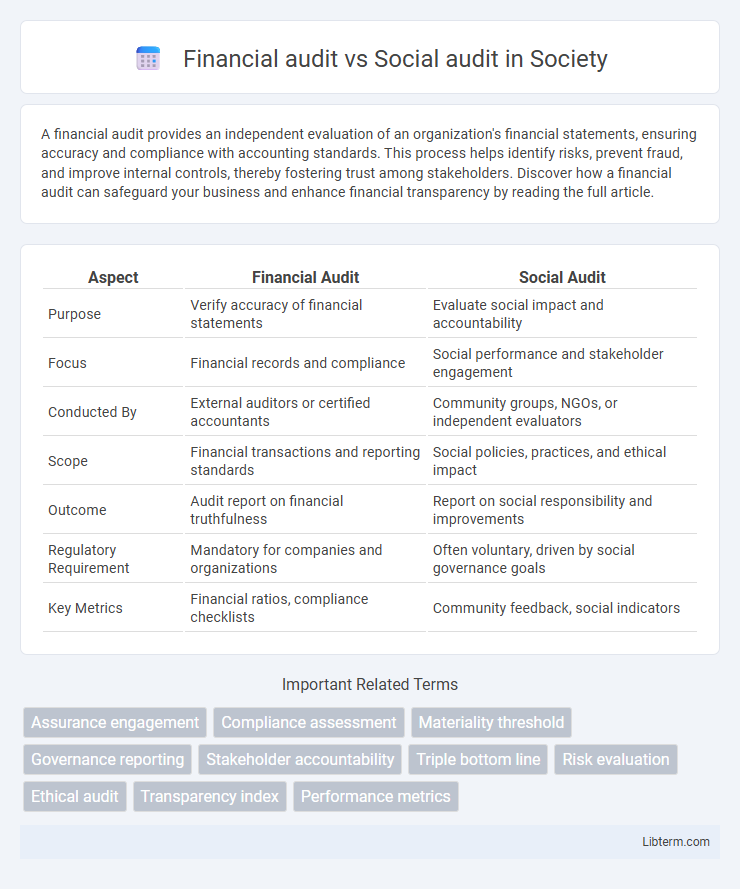

| Aspect | Financial Audit | Social Audit |

|---|---|---|

| Purpose | Verify accuracy of financial statements | Evaluate social impact and accountability |

| Focus | Financial records and compliance | Social performance and stakeholder engagement |

| Conducted By | External auditors or certified accountants | Community groups, NGOs, or independent evaluators |

| Scope | Financial transactions and reporting standards | Social policies, practices, and ethical impact |

| Outcome | Audit report on financial truthfulness | Report on social responsibility and improvements |

| Regulatory Requirement | Mandatory for companies and organizations | Often voluntary, driven by social governance goals |

| Key Metrics | Financial ratios, compliance checklists | Community feedback, social indicators |

Introduction to Financial Audit and Social Audit

Financial audit evaluates an organization's financial statements to ensure accuracy, compliance with accounting standards, and detection of fraud, providing stakeholders with reliable financial information. Social audit assesses an organization's social responsibility, community impact, and ethical practices by examining policies, activities, and outcomes related to social and environmental goals. Both audits enhance transparency and accountability but focus on distinct dimensions: monetary integrity versus social performance.

Definition and Key Objectives of Financial Audit

A financial audit is a systematic examination of an organization's financial statements and related records to ensure accuracy, compliance with accounting standards, and fair representation of financial position. The key objectives include verifying the correctness of financial data, detecting fraud or errors, and providing assurance to stakeholders about the integrity of financial reporting. Unlike social audits that assess social impact and corporate social responsibility, financial audits primarily focus on financial accuracy and regulatory compliance.

Definition and Key Objectives of Social Audit

Financial audit evaluates the accuracy and fairness of an organization's financial statements, ensuring compliance with accounting standards and regulations. Social audit assesses an organization's social impact, accountability, and adherence to ethical practices, focusing on transparency, community engagement, and social responsibility. Key objectives of social audit include measuring social performance, enhancing stakeholder trust, and promoting sustainable development through responsible corporate behavior.

Core Differences Between Financial and Social Audits

Financial audits primarily assess the accuracy and fairness of an organization's financial statements, ensuring compliance with accounting standards and regulatory requirements. Social audits evaluate an organization's social performance, including its impact on stakeholders, community engagement, and adherence to ethical practices. The core differences lie in their objectives: financial audits focus on monetary accuracy and transparency, while social audits emphasize social responsibility and sustainable development outcomes.

Methodology and Processes: Financial vs Social Auditing

Financial audit methodology centers on analyzing quantitative financial records through standardized processes such as risk assessment, sampling, and testing internal controls to ensure accuracy and compliance with accounting standards. Social audit processes emphasize qualitative evaluation of social performance, stakeholder engagement, and impact measurement, often using surveys, interviews, and community consultations to assess ethical practices and social responsibility. The structured, compliance-driven nature of financial auditing contrasts with the more interpretive, participatory approach characteristic of social auditing methodologies.

Compliance Standards: Regulatory vs Voluntary Frameworks

Financial audits strictly follow regulatory compliance standards such as GAAP, IFRS, or SOX to ensure accuracy and legality of financial statements. Social audits operate within voluntary frameworks like GRI, SASB, or ISO 26000, emphasizing ethical practices, social responsibility, and stakeholder engagement. Both audits provide accountability but differ fundamentally in scope and adherence, with financial audits mandated by law and social audits driven by organizational commitment to sustainability and transparency.

Stakeholders Involved in Financial and Social Audits

Financial audits primarily involve internal stakeholders such as company management, shareholders, auditors, and regulatory authorities focused on verifying the accuracy of financial statements. Social audits engage a broader range of stakeholders including community members, employees, non-governmental organizations (NGOs), and social activists who assess the social impact and ethical practices of an organization. The involvement in social audits reflects a commitment to transparency and accountability beyond financial metrics, incorporating stakeholder interests linked to social responsibility and sustainability.

Benefits of Conducting Financial and Social Audits

Conducting financial audits ensures accurate financial reporting, enhances transparency for stakeholders, and helps in identifying areas to improve internal controls and prevent fraud. Social audits evaluate an organization's social impact, promoting accountability to the community and fostering trust among beneficiaries and investors. Both audits combined lead to comprehensive organizational insights, driving sustainable growth and ethical business practices.

Challenges and Limitations in Financial vs Social Auditing

Financial audits face challenges like strict regulatory compliance, complexity in financial reporting standards, and limited scope mainly focused on monetary accuracy. Social audits encounter limitations due to subjective evaluation of social impact, diverse stakeholder interests, and difficulty in quantifying qualitative outcomes. Both auditing types require specialized skills, yet social audits demand more contextual understanding of social and ethical dimensions beyond conventional financial metrics.

Conclusion: Choosing the Right Audit for Organizational Goals

Selecting the appropriate audit depends on an organization's primary objectives: financial audits ensure accuracy and compliance in financial reporting, crucial for regulatory adherence and investor confidence, while social audits assess ethical practices and social responsibility, aligning operations with community and stakeholder expectations. Organizations prioritizing transparency in financial health benefit from financial audits, whereas those emphasizing corporate social responsibility and sustainability should opt for social audits. Integrating both types may provide a comprehensive evaluation, enhancing overall accountability and long-term strategic success.

Financial audit Infographic

libterm.com

libterm.com