Equity value represents the total value of a company available to shareholders, calculated by multiplying the current share price by the total number of outstanding shares. It reflects your ownership stake in the company and is essential for assessing investment opportunities and company valuation. Explore the rest of this article to understand how equity value impacts financial analysis and decision-making.

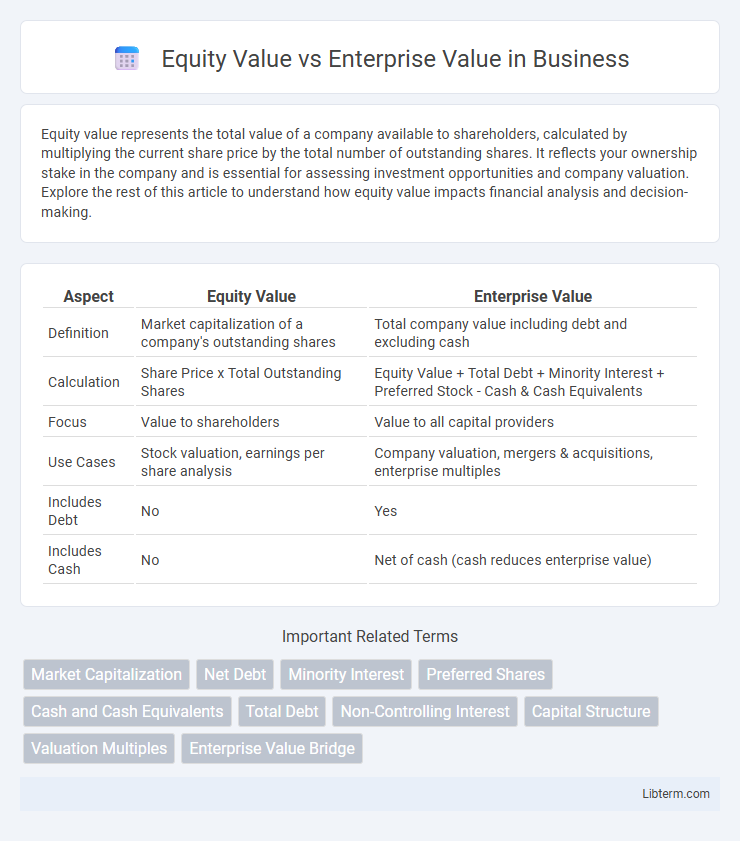

Table of Comparison

| Aspect | Equity Value | Enterprise Value |

|---|---|---|

| Definition | Market capitalization of a company's outstanding shares | Total company value including debt and excluding cash |

| Calculation | Share Price x Total Outstanding Shares | Equity Value + Total Debt + Minority Interest + Preferred Stock - Cash & Cash Equivalents |

| Focus | Value to shareholders | Value to all capital providers |

| Use Cases | Stock valuation, earnings per share analysis | Company valuation, mergers & acquisitions, enterprise multiples |

| Includes Debt | No | Yes |

| Includes Cash | No | Net of cash (cash reduces enterprise value) |

Introduction to Equity Value and Enterprise Value

Equity Value represents the total market value of a company's outstanding shares, reflecting the value available to shareholders. Enterprise Value (EV) measures a company's total value by including Equity Value, debt, minority interest, and subtracting cash and cash equivalents. EV offers a comprehensive valuation metric, crucial for assessing acquisition costs and comparing companies with different capital structures.

Key Definitions: Equity Value vs Enterprise Value

Equity Value represents the market value of a company's outstanding shares, reflecting the ownership value available to shareholders. Enterprise Value (EV) measures the total value of a company, including equity, debt, and cash, providing a comprehensive valuation for potential acquisition or investment analysis. While Equity Value focuses on shareholder interest, Enterprise Value accounts for the entire capital structure, making it essential for assessing a firm's overall financial health and value.

Components of Equity Value

Equity Value represents the total value attributable to shareholders and primarily includes common stock, preferred stock, retained earnings, and additional paid-in capital. It reflects the market capitalization plus minority interest and certain equity-linked securities like stock options and warrants. Understanding these components is essential for accurately assessing a company's ownership value separate from its debt obligations.

Components of Enterprise Value

Enterprise Value (EV) measures a company's total value by combining Equity Value, total debt, preferred stock, and minority interest, then subtracting cash and cash equivalents to reflect net operational value. Debt components include both short-term and long-term interest-bearing liabilities, ensuring a comprehensive valuation of financial obligations. This metric provides investors with a clearer picture of acquisition costs by accounting for capital structure differences beyond just market capitalization.

Key Differences Between Equity Value and Enterprise Value

Equity Value represents the total market value of a company's outstanding shares, reflecting the ownership interest available to shareholders. Enterprise Value measures the company's total value by adding debt, minority interest, and preferred equity to Equity Value, then subtracting cash and cash equivalents, providing a comprehensive valuation including all capital sources. Key differences lie in scope: Equity Value focuses solely on shareholder equity, while Enterprise Value accounts for debt and cash, offering a more complete picture of company value for acquisitions or financial analysis.

Calculating Equity Value: Methods and Formulas

Equity value is calculated by multiplying a company's current share price by its total outstanding shares, representing the market value of shareholders' ownership. Alternative methods include adjusting enterprise value by subtracting net debt, preferred stock, and non-controlling interests to isolate the equity portion. Using formulas, Equity Value = Enterprise Value - Net Debt - Preferred Stock - Non-controlling Interest provides a comprehensive approach to accurately determine equity value.

Calculating Enterprise Value: Methods and Formulas

Enterprise Value (EV) is calculated by summing Market Capitalization, Total Debt, and Preferred Stock, then subtracting Cash and Cash Equivalents, providing a comprehensive measure of a company's total value. Formulas for EV include EV = Market Cap + Total Debt + Preferred Stock - Cash, reflecting the cost to acquire the entire business including debt obligations. Methods to calculate EV can vary by considering minority interest and non-operating assets, ensuring accurate valuation for mergers, acquisitions, and financial analysis.

Importance in Valuation and M&A Analysis

Equity Value represents the shareholders' ownership in a company and is crucial for assessing stock market capitalization and shareholder returns in valuation and M&A analysis. Enterprise Value provides a holistic measure of a company's total value, including debt, preferred shares, and excluding cash, making it essential for comparing companies with different capital structures. Accurate interpretation of both Equity Value and Enterprise Value enables investors and analysts to make informed decisions regarding acquisition pricing, financing strategies, and overall company valuation.

Practical Examples and Case Studies

Equity Value represents the market capitalization of a company's outstanding shares, calculated by multiplying the share price by total shares, while Enterprise Value (EV) includes Equity Value plus debt minus cash, providing a comprehensive valuation reflecting total company value regardless of capital structure. In practical scenarios, a company with $100 million Equity Value, $30 million debt, and $10 million cash would have an EV of $120 million, revealing a more accurate purchase price for potential acquirers. Case studies, such as analyzing Tesla's growth, demonstrate how shifts in debt and cash significantly influence EV, offering investors better insight into acquisition costs and operational efficiency compared to Equity Value alone.

Conclusion: Choosing the Right Metric

Equity value reflects the market capitalization available to shareholders, making it essential for assessing shareholder wealth and stock valuation. Enterprise value provides a comprehensive measure of a company's total value, including debt and cash, critical for evaluating acquisition targets and overall firm valuation. Selecting between equity value and enterprise value depends on the analysis goal: use equity value for shareholder-focused insights and enterprise value for understanding total business value across capital structure.

Equity Value Infographic

libterm.com

libterm.com