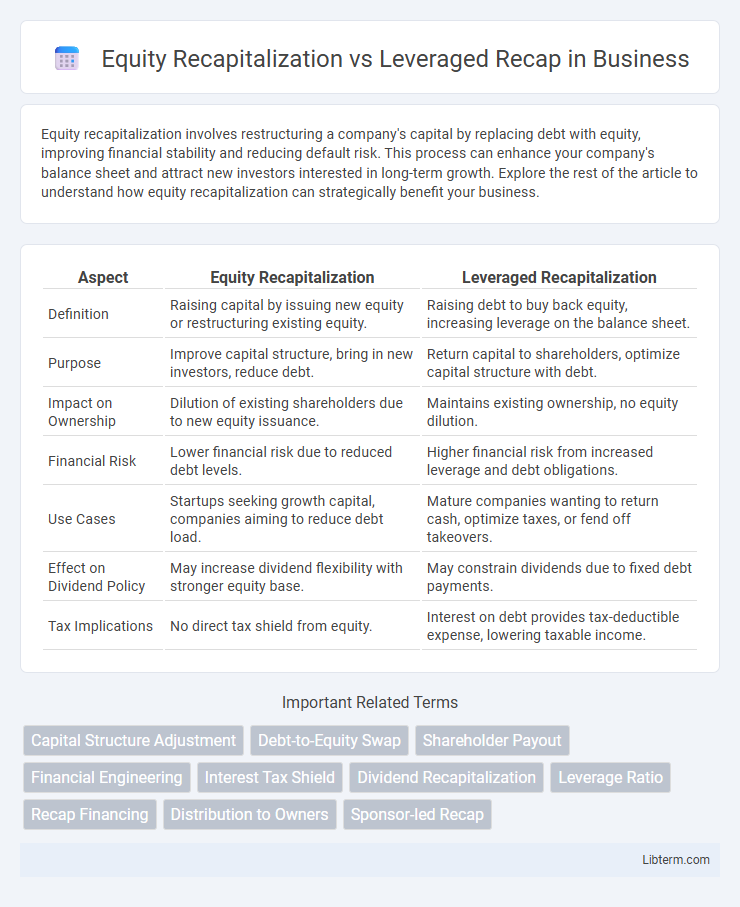

Equity recapitalization involves restructuring a company's capital by replacing debt with equity, improving financial stability and reducing default risk. This process can enhance your company's balance sheet and attract new investors interested in long-term growth. Explore the rest of the article to understand how equity recapitalization can strategically benefit your business.

Table of Comparison

| Aspect | Equity Recapitalization | Leveraged Recapitalization |

|---|---|---|

| Definition | Raising capital by issuing new equity or restructuring existing equity. | Raising debt to buy back equity, increasing leverage on the balance sheet. |

| Purpose | Improve capital structure, bring in new investors, reduce debt. | Return capital to shareholders, optimize capital structure with debt. |

| Impact on Ownership | Dilution of existing shareholders due to new equity issuance. | Maintains existing ownership, no equity dilution. |

| Financial Risk | Lower financial risk due to reduced debt levels. | Higher financial risk from increased leverage and debt obligations. |

| Use Cases | Startups seeking growth capital, companies aiming to reduce debt load. | Mature companies wanting to return cash, optimize taxes, or fend off takeovers. |

| Effect on Dividend Policy | May increase dividend flexibility with stronger equity base. | May constrain dividends due to fixed debt payments. |

| Tax Implications | No direct tax shield from equity. | Interest on debt provides tax-deductible expense, lowering taxable income. |

Introduction to Equity Recapitalization and Leveraged Recap

Equity recapitalization involves restructuring a company's capital by issuing new equity to reduce debt or raise funds, enhancing financial stability and shareholder value. Leveraged recapitalization, by contrast, increases debt to repurchase equity, optimizing capital structure and often triggering tax benefits. Both strategies serve distinct corporate finance goals by balancing debt and equity to improve liquidity and leverage ratios.

Defining Equity Recapitalization

Equity recapitalization involves restructuring a company's capital by replacing debt with equity or issuing new equity to improve the balance sheet and reduce financial risk. This process enhances liquidity and strengthens the equity base, providing stability and growth potential without increasing debt burden. In contrast, leveraged recapitalization uses significant debt to repurchase shares or pay dividends, increasing leverage while balancing equity levels.

Understanding Leveraged Recapitalization

Leveraged recapitalization involves restructuring a company's debt and equity by issuing significant new debt to pay dividends or repurchase shares, increasing leverage while maintaining control for existing shareholders. This strategy enhances shareholder value by optimizing the capital structure, often improving return on equity (ROE) and signaling confidence in future cash flows. Understanding leveraged recapitalization is crucial for corporate finance professionals seeking alternatives to equity issuance or full buyouts while managing risk and liquidity.

Key Differences between Equity and Leveraged Recaps

Equity recapitalization involves raising capital by issuing new shares, which dilutes existing ownership but strengthens the balance sheet without increasing debt. Leveraged recapitalization uses significant debt to repurchase equity, increasing financial leverage and potentially boosting returns while raising bankruptcy risk. The key difference lies in the impact on capital structure: equity recaps reduce leverage and dilute ownership, whereas leveraged recaps increase leverage and consolidate ownership.

Strategic Reasons for Equity Recapitalization

Equity recapitalization is primarily pursued to enhance a company's financial flexibility by reducing debt levels and attracting new investors, which strengthens the balance sheet and supports long-term growth initiatives. It allows businesses to optimize their capital structure by injecting fresh equity while avoiding the constraints and risks associated with increased leverage. This strategic move helps companies improve credit ratings, facilitate acquisitions, and fund expansion without overburdening cash flows with debt repayments.

Benefits and Risks of Leveraged Recap

Leveraged recapitalization offers benefits such as enhanced shareholder value through increased debt usage to fund share buybacks or dividends, improved capital structure efficiency, and potential tax advantages due to interest deductibility. However, risks include heightened financial leverage leading to increased bankruptcy risk, reduced financial flexibility, and pressure on cash flow to meet interest obligations. Companies must carefully balance the trade-offs between immediate shareholder returns and long-term solvency when opting for a leveraged recap.

Impact on Company Capital Structure

Equity recapitalization involves raising capital by issuing new equity, which reduces debt ratios and enhances the company's balance sheet stability by diluting ownership but improving liquidity. Leveraged recapitalization increases debt levels by borrowing to repurchase shares or pay dividends, significantly boosting financial leverage and interest obligations while potentially enhancing shareholder returns. Both strategies fundamentally alter the capital structure, with equity recaps prioritizing lower leverage and risk, and leveraged recaps emphasizing higher leverage and potential tax benefits.

Effects on Shareholder Value and Control

Equity recapitalization dilutes existing shareholders but strengthens the balance sheet by issuing new equity, often improving shareholder value through reduced financial risk and increased growth potential. Leveraged recapitalization increases debt to repurchase shares, boosting shareholder value by enhancing earnings per share and tax benefits, but it also raises financial risk and may restrict control due to debt covenants. Control dynamics shift as equity recapitalization can introduce new shareholders, diluting existing power, whereas leveraged recap focuses ownership while increasing creditor influence over key decisions.

Real-World Examples of Each Recapitalization Method

Equity recapitalization often involves companies like Tesla issuing new shares to raise capital and reduce debt, providing financial flexibility without increasing leverage. Leveraged recapitalization is exemplified by Dell's 2013 buyout, where substantial debt was used to repurchase equity, shifting the capital structure toward higher leverage while returning value to shareholders. Both methods impact company valuation and risk profile distinctly, reflecting strategic financial management in real-world corporate finance.

Choosing the Right Recapitalization Strategy

Equity recapitalization involves restructuring a company's equity by issuing new shares to raise capital, often diluting existing ownership but improving financial stability. Leveraged recapitalization uses significant debt to buy back shares or pay dividends, increasing leverage and potentially boosting returns but raising financial risk. Choosing the right recapitalization strategy depends on the company's capital structure, growth objectives, risk tolerance, and market conditions to balance financial flexibility and shareholder value.

Equity Recapitalization Infographic

libterm.com

libterm.com