Non-controlling interest represents the equity stake in a subsidiary not owned by the parent company, reflecting the portion of profits and net assets attributable to minority shareholders. Accurately accounting for non-controlling interest is essential for transparent financial reporting and effective investment analysis. Explore the rest of the article to understand how non-controlling interest impacts consolidated financial statements and your investment decisions.

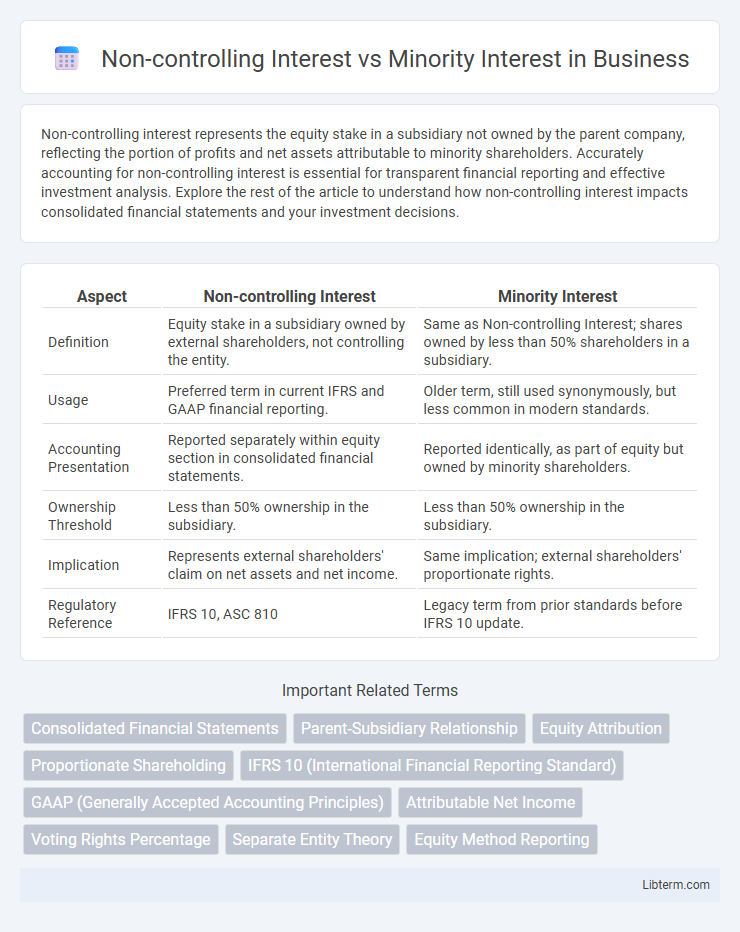

Table of Comparison

| Aspect | Non-controlling Interest | Minority Interest |

|---|---|---|

| Definition | Equity stake in a subsidiary owned by external shareholders, not controlling the entity. | Same as Non-controlling Interest; shares owned by less than 50% shareholders in a subsidiary. |

| Usage | Preferred term in current IFRS and GAAP financial reporting. | Older term, still used synonymously, but less common in modern standards. |

| Accounting Presentation | Reported separately within equity section in consolidated financial statements. | Reported identically, as part of equity but owned by minority shareholders. |

| Ownership Threshold | Less than 50% ownership in the subsidiary. | Less than 50% ownership in the subsidiary. |

| Implication | Represents external shareholders' claim on net assets and net income. | Same implication; external shareholders' proportionate rights. |

| Regulatory Reference | IFRS 10, ASC 810 | Legacy term from prior standards before IFRS 10 update. |

Understanding Non-controlling Interest

Non-controlling interest represents the equity stake in a subsidiary not owned by the parent company, reflecting the portion of net assets and net income attributable to external shareholders. It appears in consolidated financial statements under equity, distinct from liabilities, to show minority shareholders' claim on the subsidiary's net assets. Understanding non-controlling interest is crucial for accurate financial analysis, as it affects equity valuation, profitability ratios, and the representation of ownership structure in corporate financial disclosures.

Defining Minority Interest

Minority Interest refers to the ownership stake in a subsidiary company held by shareholders other than the parent company, typically representing less than 50% of the subsidiary's equity. It signifies the portion of net assets and net income attributable to these external shareholders on consolidated financial statements. Distinct from Non-controlling Interest, which is the preferred accounting term, Minority Interest emphasizes ownership level rather than control dynamics.

Key Differences Between Non-controlling and Minority Interest

Non-controlling interest refers to the equity stake in a subsidiary not owned by the parent company, representing the portion of ownership without controlling power. Minority interest is essentially synonymous, denoting the same share of ownership held by outside shareholders in a subsidiary, but terminology may differ based on accounting standards or reporting contexts. Key differences lie in usage: non-controlling interest is preferred under IFRS for consolidated financial statements, while minority interest is commonly used under U.S. GAAP.

Accounting Treatment of Non-controlling Interest

Non-controlling Interest (NCI) represents the equity stake in a subsidiary not owned by the parent company and is reported in consolidated financial statements within equity but separate from the parent shareholders' equity. The accounting treatment of NCI requires recognition of NCI at fair value or the proportionate share of the subsidiary's net assets at the acquisition date, with subsequent adjustments for the subsidiary's post-acquisition profits or losses and dividends. This treatment ensures transparency in attributing income, losses, and equity changes between controlling and non-controlling shareholders in consolidation accounting.

Reporting Minority Interest in Financial Statements

Non-controlling interest (NCI) and minority interest refer to the ownership stake in a subsidiary not held by the parent company and are reported under equity in consolidated financial statements. Reporting minority interest involves presenting NCI separately within equity to reflect the portion of subsidiary net assets and net income that is attributable to outside shareholders. Accurate disclosure of NCI ensures transparency in ownership structure, impacting the calculation of consolidated earnings per share and overall financial position.

Impact on Consolidated Financial Statements

Non-controlling interest and minority interest both represent the ownership stake in a subsidiary not held by the parent company, affecting consolidated financial statements by reflecting the portion of net assets and income attributable to outside shareholders. Non-controlling interest is presented in the equity section of the consolidated balance sheet and adjusts consolidated net income to allocate profit or loss to non-controlling shareholders. Accurate disclosure of these interests ensures transparency in equity ownership and prevents overstatement of the parent company's financial performance and position.

IFRS vs GAAP: Non-controlling and Minority Interest

Non-controlling interest (NCI) and minority interest both represent ownership stakes in a subsidiary not held by the parent company, but IFRS uses the term "non-controlling interest" to emphasize the right to a share of profits and assets, whereas US GAAP traditionally uses "minority interest." IFRS requires NCI to be measured either at fair value or at the proportionate share of the subsidiary's identifiable net assets, impacting consolidated equity presentation, while US GAAP measures minority interest at fair value, reflecting potential differences in reported equity and profit allocation. The distinction affects financial statement disclosures, consolidation procedures, and equity attribution, highlighting key differences in accounting treatment under IFRS and US GAAP frameworks.

Practical Examples and Calculations

Non-controlling Interest (NCI) and Minority Interest both represent ownership stakes in a subsidiary held by investors other than the parent company, but NCI is the preferred modern term under IFRS. For example, if a parent company owns 80% of a subsidiary valued at $1 million, the Non-controlling Interest equals 20% or $200,000. In consolidation, NCI is calculated by applying the minority percentage to the subsidiary's net identifiable assets, ensuring accurate reflection of the portion not owned by the parent.

Common Misconceptions

Non-controlling interest and minority interest are often mistakenly treated as different concepts, but they both refer to the ownership stake in a subsidiary not held by the parent company, typically represented in consolidated financial statements. A common misconception is that minority interest implies less influence or control, whereas the term non-controlling interest explicitly acknowledges the lack of control regardless of ownership percentage. Clarifying this distinction improves understanding of how equity is reported and the impact on net income allocation between controlling and non-controlling shareholders.

Importance for Investors and Stakeholders

Non-controlling interest and minority interest represent the equity stake held by investors who do not control a company, providing critical insight into the ownership distribution and corporate governance. Understanding these interests helps investors assess the degree of influence minority shareholders have on financial decisions and the potential risks associated with control dilution. Accurate reporting of non-controlling interest enhances transparency, enabling stakeholders to better evaluate company performance and make informed investment decisions.

Non-controlling Interest Infographic

libterm.com

libterm.com