Effective board committee structure enhances governance by clearly defining roles and responsibilities, ensuring focused oversight on key areas like audit, risk, and remuneration. Specialized committees improve decision-making efficiency and accountability, aligning the board's priorities with organizational goals. Discover how optimizing your board committee structure can strengthen leadership and drive success in the rest of this article.

Table of Comparison

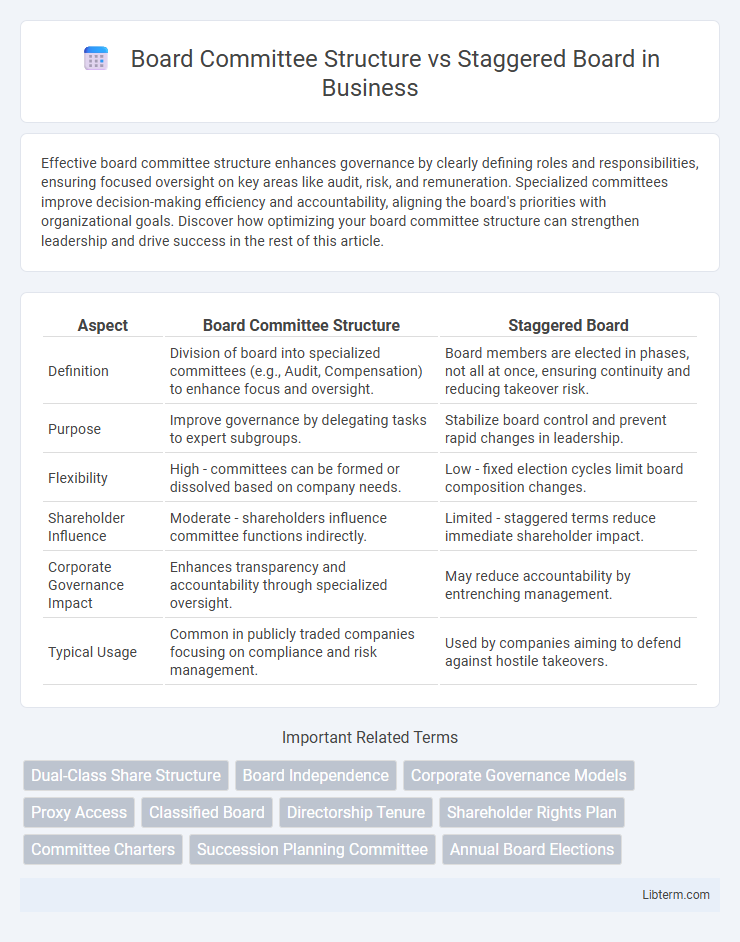

| Aspect | Board Committee Structure | Staggered Board |

|---|---|---|

| Definition | Division of board into specialized committees (e.g., Audit, Compensation) to enhance focus and oversight. | Board members are elected in phases, not all at once, ensuring continuity and reducing takeover risk. |

| Purpose | Improve governance by delegating tasks to expert subgroups. | Stabilize board control and prevent rapid changes in leadership. |

| Flexibility | High - committees can be formed or dissolved based on company needs. | Low - fixed election cycles limit board composition changes. |

| Shareholder Influence | Moderate - shareholders influence committee functions indirectly. | Limited - staggered terms reduce immediate shareholder impact. |

| Corporate Governance Impact | Enhances transparency and accountability through specialized oversight. | May reduce accountability by entrenching management. |

| Typical Usage | Common in publicly traded companies focusing on compliance and risk management. | Used by companies aiming to defend against hostile takeovers. |

Introduction to Board Committee Structures

Board committee structures organize directors into specialized groups such as audit, compensation, and governance committees to enhance oversight and decision-making efficiency. These committees focus on specific areas of corporate governance, ensuring thorough review of financial reporting, executive remuneration, and board nominations. Compared to staggered boards, which entrench directors by electing them in phases, committee structures promote accountability through focused expertise and regular performance assessments.

What is a Staggered Board Structure?

A staggered board structure divides directors into different classes with varying election cycles, preventing the entire board from being replaced at once. This system enhances continuity and stability by ensuring only a portion of the board is up for election each year. In contrast, a board committee structure organizes directors into specialized groups focusing on specific governance areas, rather than affecting the timing of director elections.

Key Differences Between Committee Structure and Staggered Boards

Board committee structures divide responsibilities among specialized groups such as audit, compensation, and governance committees to enhance oversight and decision-making efficiency. Staggered boards, in contrast, elect directors in phases to prevent full board turnover during a single election, promoting continuity but potentially reducing responsiveness to shareholder concerns. The key difference lies in committees optimizing operational focus within the board, while staggered boards control director replacement timing to influence corporate stability and governance dynamics.

Advantages of Board Committee Structures

Board committee structures enhance corporate governance by dividing oversight responsibilities among specialized groups, improving efficiency and expertise in decision-making. Committees such as audit, compensation, and nomination focus on critical areas, ensuring thorough analysis and risk management. This specialization fosters accountability and transparency while enabling the board to address complex issues effectively.

Benefits of Staggered Board Systems

Staggered board systems enhance corporate governance by promoting board continuity and reducing susceptibility to hostile takeovers, as only a fraction of directors are elected each year. This setup allows for long-term strategic planning and stability, ensuring experienced members remain active in decision-making processes. Companies employing staggered boards often experience improved oversight and more consistent policy implementation compared to those with annual full board elections.

Drawbacks of Board Committee Approach

The Board Committee Structure often leads to fragmented decision-making and slower response times due to the division of responsibilities among various specialized groups. This separation can result in communication gaps and a lack of cohesive strategy, hindering effective governance. Compared to a Staggered Board, committees may struggle with accountability issues, as overlapping roles create ambiguity in leadership and oversight functions.

Challenges with Staggered Board Implementation

Implementing a staggered board often creates challenges in maintaining consistent governance due to extended director terms, which can reduce board accountability and slow strategic decision-making. This structure complicates the replacement process, limiting shareholders' ability to influence board composition quickly and potentially entrenching management interests. The staggered board's resistance to change can conflict with dynamic market demands, presenting obstacles in aligning committee responsibilities effectively across election cycles.

Impact on Corporate Governance

Board committee structure enhances corporate governance by distributing oversight responsibilities across specialized groups, improving decision-making efficiency and risk management. In contrast, staggered boards, where only a fraction of directors face election each year, can entrench management and reduce board accountability, potentially weakening governance. Effective governance often depends on balancing structured committee roles with board refreshment mechanisms to ensure both expertise and responsiveness.

Effectiveness in Mitigating Hostile Takeovers

Board committee structures enhance oversight by assigning specialized roles to subgroups, improving governance and responsiveness to takeover threats. Staggered boards, where only a fraction of directors are elected each year, create time barriers that delay hostile takeover attempts and provide strategic defense. Combining committee expertise with staggered election timing significantly strengthens a corporation's ability to mitigate hostile acquisition risks.

Choosing the Right Board Structure for Your Organization

Selecting the optimal board structure involves understanding the distinctions between a committee-based approach and a staggered board system, where committees enhance specialization and efficiency by delegating specific responsibilities such as audit, compensation, and governance. A staggered board, characterized by rotating director terms, offers continuity and stability in leadership, which can prevent hostile takeovers but may reduce responsiveness to shareholder concerns. Organizations must evaluate their strategic priorities, governance goals, and shareholder expectations to determine whether a focused committee structure or a staggered board aligns better with their long-term vision and operational needs.

Board Committee Structure Infographic

libterm.com

libterm.com