Status quo bias is a cognitive tendency where individuals prefer to maintain their current situation rather than change, even when alternatives may offer better outcomes. This bias often leads to resistance to change and can impact decision-making in personal finance, business, and daily life. Explore the rest of the article to understand how status quo bias affects your choices and ways to overcome it.

Table of Comparison

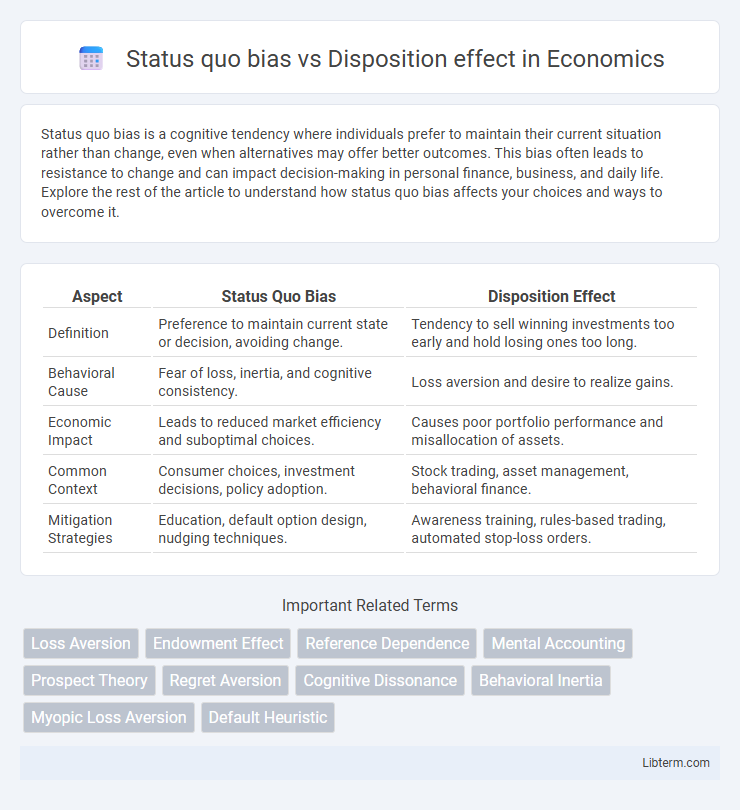

| Aspect | Status Quo Bias | Disposition Effect |

|---|---|---|

| Definition | Preference to maintain current state or decision, avoiding change. | Tendency to sell winning investments too early and hold losing ones too long. |

| Behavioral Cause | Fear of loss, inertia, and cognitive consistency. | Loss aversion and desire to realize gains. |

| Economic Impact | Leads to reduced market efficiency and suboptimal choices. | Causes poor portfolio performance and misallocation of assets. |

| Common Context | Consumer choices, investment decisions, policy adoption. | Stock trading, asset management, behavioral finance. |

| Mitigation Strategies | Education, default option design, nudging techniques. | Awareness training, rules-based trading, automated stop-loss orders. |

Understanding Status Quo Bias

Status quo bias refers to the cognitive tendency to prefer maintaining current circumstances or decisions rather than changing them, often due to perceived risks associated with change. This bias explains why individuals disproportionately stick with existing choices, even when alternatives may offer better outcomes. Understanding status quo bias is essential in behavioral finance and decision-making, as it highlights resistance to change despite potential gains.

Defining the Disposition Effect

The disposition effect refers to investors' tendency to sell assets that have increased in value while holding on to assets that have declined, driven by the desire to avoid realizing losses. This behavioral bias contrasts with status quo bias, where individuals prefer to maintain their current state rather than make changes. Understanding the disposition effect is crucial in financial decision-making as it impacts trading patterns and portfolio performance.

Psychological Roots of Status Quo Bias

Status quo bias stems from an inherent preference for maintaining current conditions due to loss aversion and cognitive inertia, leading individuals to avoid change even when better options exist. This psychological root is closely linked to the disposition effect, where investors irrationally hold losing assets to avoid realizing losses, reinforcing a tendency to stick with the familiar. Understanding these biases reveals the deep cognitive processes that promote decision-making anchored in existing states rather than optimal outcomes.

Triggers and Causes of the Disposition Effect

The disposition effect is primarily triggered by investors' cognitive biases such as loss aversion and the desire to avoid regret, causing them to sell winning stocks prematurely while holding onto losing stocks to avoid realizing losses. Emotional responses to market fluctuations and overconfidence in personal investment decisions also contribute to this behavior, reinforcing the reluctance to sell depreciating assets. Psychological factors including mental accounting and the need for self-justification further exacerbate the disposition effect, distinguishing it from the more general status quo bias that favors maintaining current decisions or positions without specific emotional triggers.

Key Differences Between Status Quo Bias and Disposition Effect

Status quo bias refers to the preference for maintaining current situations or decisions, often driven by loss aversion and a desire to avoid change. The disposition effect describes the tendency of investors to sell winning assets too early while holding on to losing assets too long, influenced by regret aversion and mental accounting. Key differences include that status quo bias centers on resisting change regardless of asset performance, whereas the disposition effect specifically relates to trading behavior based on realized and unrealized gains.

Real-World Examples in Financial Decision Making

Status quo bias leads investors to hold on to underperforming assets, as demonstrated by retirees reluctant to rebalance their portfolios despite changing market conditions. The disposition effect manifests when traders sell winning stocks too quickly but retain losing investments, observed in individual investors during volatile market downturns. Both biases contribute to suboptimal financial decisions, reducing overall portfolio performance and highlighting the importance of behavioral awareness in investment strategies.

Behavioral Economics Insights: Comparing the Two Biases

Status quo bias in behavioral economics describes individuals' preference for maintaining current conditions, leading to resistance against change even when alternatives may be beneficial. The disposition effect refers to investors' tendency to sell winning assets too early while holding onto losing assets, driven by loss aversion and emotional decision-making. Both biases highlight the impact of psychological factors on financial behavior, with status quo bias emphasizing inertia and the disposition effect illustrating asymmetric risk-taking in investment choices.

Impacts on Investment Strategies and Outcomes

Status quo bias leads investors to stick with existing holdings, resulting in missed opportunities for portfolio diversification and growth. The disposition effect causes premature selling of winning assets while holding losing ones, negatively impacting overall returns by locking in gains and accumulating losses. Both biases distort optimal decision-making and impair long-term investment performance.

Overcoming Status Quo Bias and Disposition Effect

Overcoming status quo bias and the disposition effect requires strategies that promote active decision-making and emotional detachment from investments. Techniques such as setting predefined rules for buying and selling, utilizing automated investment platforms, and regularly reviewing portfolio performance can reduce the influence of inertia and regret aversion. Cognitive-behavioral training and financial education further empower investors to recognize these biases and adopt more rational investment behaviors.

Practical Tips for Better Decision-Making

Status quo bias causes individuals to prefer maintaining current situations, while the disposition effect leads investors to hold losing assets too long and sell winners too early. To improve decision-making, regularly review investment portfolios using objective criteria rather than emotional attachment or loss aversion. Implementing preset sell and buy rules can reduce bias impact and facilitate more rational financial choices.

Status quo bias Infographic

libterm.com

libterm.com