Open market operations involve the buying and selling of government securities by central banks to regulate the money supply and control inflation. These transactions influence interest rates, liquidity, and overall economic stability, making them a crucial tool for monetary policy implementation. Explore the full article to understand how open market operations impact your financial environment and the broader economy.

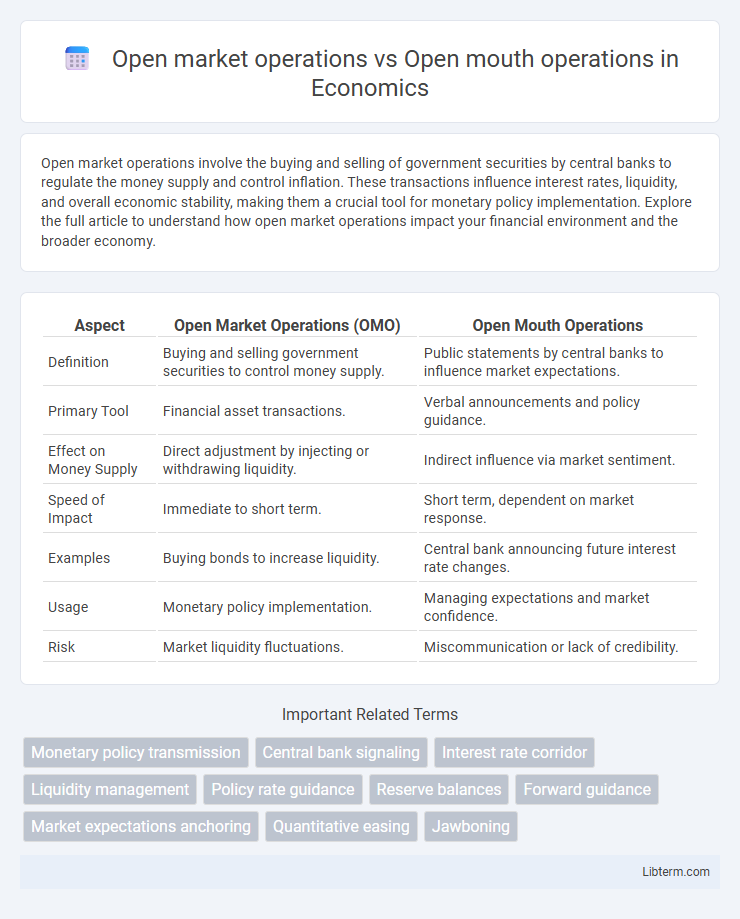

Table of Comparison

| Aspect | Open Market Operations (OMO) | Open Mouth Operations |

|---|---|---|

| Definition | Buying and selling government securities to control money supply. | Public statements by central banks to influence market expectations. |

| Primary Tool | Financial asset transactions. | Verbal announcements and policy guidance. |

| Effect on Money Supply | Direct adjustment by injecting or withdrawing liquidity. | Indirect influence via market sentiment. |

| Speed of Impact | Immediate to short term. | Short term, dependent on market response. |

| Examples | Buying bonds to increase liquidity. | Central bank announcing future interest rate changes. |

| Usage | Monetary policy implementation. | Managing expectations and market confidence. |

| Risk | Market liquidity fluctuations. | Miscommunication or lack of credibility. |

Understanding Open Market Operations: An Overview

Open Market Operations (OMO) refer to the buying and selling of government securities by a central bank to regulate money supply and control inflation. Open Mouth Operations involve central bank communication and public statements aimed at influencing market expectations without immediate trade actions. Understanding Open Market Operations requires recognizing their direct impact on liquidity, interest rates, and monetary policy implementation.

What Are Open Mouth Operations?

Open Mouth Operations refer to central bank strategies where policymakers use verbal communication to influence market expectations and guide interest rates without actual trading of securities. This approach is designed to manage inflation expectations and stabilize financial markets by signaling future monetary policy intentions. Unlike Open Market Operations, which involve buying or selling government securities to adjust liquidity, Open Mouth Operations rely solely on credible statements and announcements to shape economic behavior.

Key Differences Between OMO and OMO (Verbal vs. Transactional)

Open Market Operations (OMO) involve the Central Bank's direct buying or selling of government securities to regulate money supply and interest rates in the economy, representing transactional interventions. Open Mouth Operations (OMO, verbal) refer to the Central Bank's use of public statements or communications to influence market expectations and guide economic behavior without actual transactions. The key difference lies in OMO being a tangible, market-based tool affecting liquidity, while Open Mouth Operations rely on verbal signaling to shape perceptions and financial decisions.

Objectives of Central Banks: OMOs vs. Verbal Policy Guidance

Open Market Operations (OMOs) enable central banks to directly influence liquidity and short-term interest rates by buying or selling government securities, targeting inflation control and economic stability. Open Mouth Operations involve central banks using verbal policy guidance to shape market expectations and signal future monetary policy, aiming to manage investor behavior and reduce market volatility. Both tools are essential for achieving central banks' objectives of price stability and sustainable economic growth, with OMOs offering immediate liquidity control and verbal guidance steering long-term market confidence.

Mechanisms: How Open Market Operations Influence Liquidity

Open Market Operations (OMO) influence liquidity by buying or selling government securities in the open market, which directly adjusts the reserves of commercial banks and the overall money supply. Purchasing securities injects liquidity into the banking system, lowering interest rates, while selling securities withdraws liquidity, tightening credit availability. Open Mouth Operations rely on central bank communication to shape market expectations about future monetary policy, indirectly influencing liquidity by affecting investor and bank behavior without immediate asset transactions.

The Power of Central Bank Communication: Open Mouth Operations

Open Mouth Operations leverage central bank communication to influence market expectations and guide economic behavior without immediate asset transactions, enhancing monetary policy effectiveness. Clear signaling by central banks can shape interest rate outlooks and inflation expectations, reducing market volatility and enhancing policy transparency. Unlike Open Market Operations, which involve direct buying or selling of government securities, Open Mouth Operations rely on the strategic dissemination of forward guidance to stabilize financial markets and support economic objectives.

Effectiveness: When Words Move Markets

Open market operations directly influence liquidity and interest rates by buying or selling government securities, providing immediate and measurable effects on the economy. Open mouth operations rely on central bank communication and forward guidance to shape market expectations and investor behavior, sometimes yielding swift but less predictable market reactions. Effectiveness depends on credibility and context, with open mouth operations excelling when markets react strongly to policy signals and open market operations delivering concrete financial adjustment.

Historical Examples of Each Approach

Open market operations, involving the buying and selling of government securities to regulate money supply, were notably used by the Federal Reserve during the 2008 financial crisis to stabilize liquidity. Open mouth operations, characterized by central banks' verbal interventions to influence market expectations, were famously employed by then-Federal Reserve Chairman Paul Volcker in the early 1980s to signal a commitment to curb inflation. Historical cases such as the Bank of Japan's verbal guidance in the 1990s showcase the effectiveness of open mouth operations in managing long-term interest rates without immediate asset transactions.

Advantages and Limitations: Open Market vs. Open Mouth

Open market operations allow central banks to efficiently control money supply and stabilize interest rates by buying or selling government securities, providing precise and immediate liquidity adjustments. However, they require active market participation and may be less effective in less liquid or underdeveloped financial markets. Open mouth operations rely on verbal guidance or policy signals to influence expectations and market behavior, offering a cost-effective and rapid tool for steering economic outlook, but their impact can be uncertain and heavily dependent on credibility and consistent communication.

Implications for Monetary Policy Strategy

Open market operations involve the central bank buying or selling government securities to regulate money supply and influence short-term interest rates, directly impacting liquidity and credit availability. Open mouth operations rely on verbal guidance or forward guidance by central bank officials to shape market expectations and influence economic behavior without immediate market transactions. Combining these tools enhances monetary policy flexibility by managing both actual liquidity conditions and market sentiment, improving the effectiveness of controlling inflation and stabilizing economic growth.

Open market operations Infographic

libterm.com

libterm.com