Selective hedge strategies allow investors to mitigate risk by carefully choosing specific assets or market segments to protect their portfolios. These targeted approaches optimize returns while minimizing exposure to market volatility, enhancing overall financial stability. Explore the rest of this article to understand how selective hedging can safeguard your investments effectively.

Table of Comparison

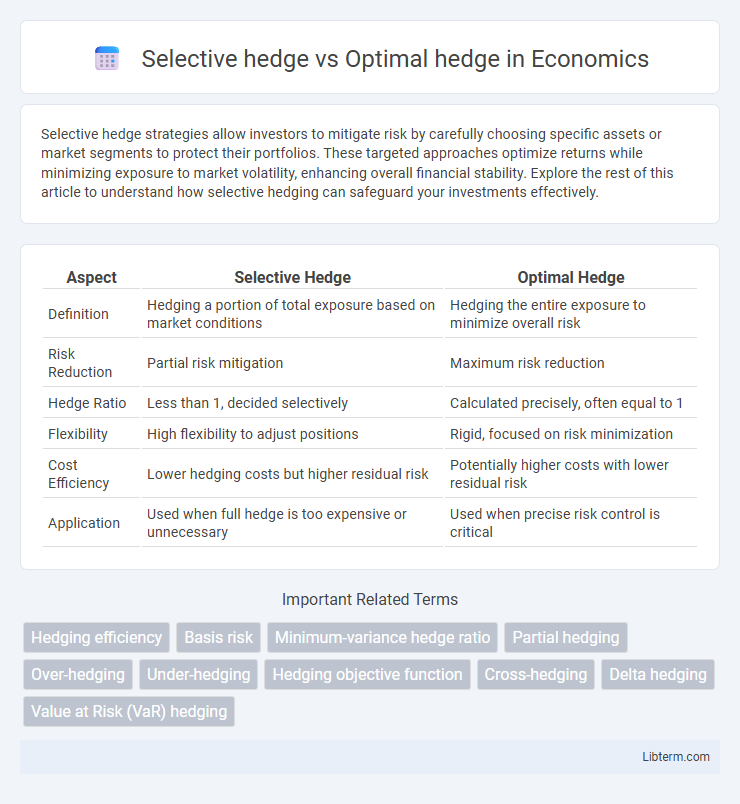

| Aspect | Selective Hedge | Optimal Hedge |

|---|---|---|

| Definition | Hedging a portion of total exposure based on market conditions | Hedging the entire exposure to minimize overall risk |

| Risk Reduction | Partial risk mitigation | Maximum risk reduction |

| Hedge Ratio | Less than 1, decided selectively | Calculated precisely, often equal to 1 |

| Flexibility | High flexibility to adjust positions | Rigid, focused on risk minimization |

| Cost Efficiency | Lower hedging costs but higher residual risk | Potentially higher costs with lower residual risk |

| Application | Used when full hedge is too expensive or unnecessary | Used when precise risk control is critical |

Introduction to Hedging Strategies

Selective hedge targets specific risk exposures by hedging only certain portions of a portfolio, optimizing cost-efficiency and flexibility. Optimal hedge employs mathematical models to determine the precise hedge ratio that minimizes risk, maximizing portfolio stability. Both strategies form core components of modern risk management practices in financial markets.

Understanding Selective Hedge

Selective hedge involves choosing specific futures contracts to hedge against targeted price risks, allowing greater flexibility in matching exposures compared to an optimal hedge, which aims to minimize overall risk with a calculated hedge ratio. Understanding selective hedge requires analyzing market conditions and risk tolerance to select contracts that align closely with anticipated price movements and individual asset characteristics. This strategy optimizes protection for distinct risk elements while potentially accepting residual exposure in less correlated areas.

What is Optimal Hedge?

Optimal hedge is a risk management strategy designed to minimize the variance of a hedged position by determining the hedge ratio that best offsets price fluctuations between the asset and its hedging instrument. This hedge ratio is calculated using the covariance between the changes in the spot price of the asset and the futures price, divided by the variance of the futures price changes. Unlike selective hedge, which relies on judgment or market conditions, optimal hedge uses quantitative methods to achieve the most efficient risk reduction.

Key Differences: Selective vs Optimal Hedging

Selective hedge involves choosing specific futures contracts to hedge particular assets or liabilities based on anticipated price movements, allowing for targeted risk management. Optimal hedge employs quantitative techniques, such as regression analysis, to determine the hedge ratio that minimizes the variance of the hedged portfolio, aiming for the most effective risk reduction. Key differences include selective hedging's reliance on judgment and market outlook, whereas optimal hedging depends on statistical models to achieve risk minimization.

Risk Assessment in Selective and Optimal Hedge

Selective hedge involves choosing specific risk exposures to hedge based on subjective judgment, often leading to partial risk reduction and potential basis risk. Optimal hedge employs quantitative models to minimize overall portfolio variance, achieving the best possible risk mitigation through precise hedge ratios. Risk assessment in selective hedging may overlook complex correlations, whereas optimal hedging rigorously evaluates market dynamics to enhance risk management effectiveness.

Cost Implications of Each Strategy

Selective hedge involves choosing specific exposures to hedge based on expected cost-effectiveness, often resulting in lower immediate hedging costs but potentially higher residual risk, impacting overall financial outcomes. Optimal hedge aims to minimize total risk by fully hedging an exposure using quantitative models, which can lead to higher upfront costs due to extensive derivative use but provides greater cost certainty and risk reduction. Cost implications of selective hedging include savings on premiums and transaction costs, while optimal hedging may incur greater fees but offsets potential loss from adverse price movements more effectively.

Practical Applications: When to Use Selective or Optimal Hedge

Selective hedge is ideal for managing risk in volatile markets by allowing traders to choose specific contracts that best align with individual asset exposures, enhancing flexibility in risk mitigation. Optimal hedge employs quantitative models to determine the hedge ratio that minimizes portfolio variance, making it practical for institutional investors seeking precise risk reduction. Use selective hedging when customization and discretion are critical, while optimal hedging suits scenarios demanding statistically driven, systematic risk management.

Real-World Examples of Hedging Approaches

Selective hedge strategies involve choosing specific risk exposures to hedge, such as a wheat farmer using futures to lock in prices for a portion of their crop, reducing price risk while maintaining upside potential. Optimal hedge approaches use quantitative models to determine the precise hedge ratio that minimizes portfolio variance, exemplified by multinational corporations employing currency forwards to balance currency risk based on statistical correlations between currency pairs. Real-world examples include airlines selectively hedging fuel costs during price volatility, contrasted with financial institutions applying optimal hedging techniques across diversified asset portfolios to stabilize returns.

Advantages and Disadvantages of Selective and Optimal Hedge

Selective hedge allows traders to partially hedge positions, reducing exposure while maintaining potential gains, but it risks incomplete risk mitigation and potential losses from unhedged portions. Optimal hedge aims to minimize risk by adjusting hedge ratios precisely based on statistical measures, providing more efficient protection, yet it requires complex calculations and may not account for market anomalies. Both strategies balance risk and cost differently, with selective hedge offering flexibility but less certainty, and optimal hedge providing mathematical rigor at the expense of simplicity.

Choosing the Right Hedge Strategy for Your Portfolio

Selective hedge strategies tailor positions based on targeted risk factors and market conditions, allowing precise control over specific portfolio exposures. Optimal hedge approaches utilize quantitative models to minimize overall portfolio variance by balancing risk reduction and cost efficiency across all assets. Choosing the right hedge strategy depends on your portfolio's risk tolerance, asset correlation, and market outlook, emphasizing customization and mathematical optimization for effective risk management.

Selective hedge Infographic

libterm.com

libterm.com