Futures price reflects the agreed-upon cost for buying or selling an asset at a predetermined future date, incorporating current market expectations and underlying factors such as supply, demand, and interest rates. Accurate understanding of futures price helps investors manage risk and capitalize on market movements effectively. Explore the article to deepen your knowledge of futures pricing and its impact on your trading strategies.

Table of Comparison

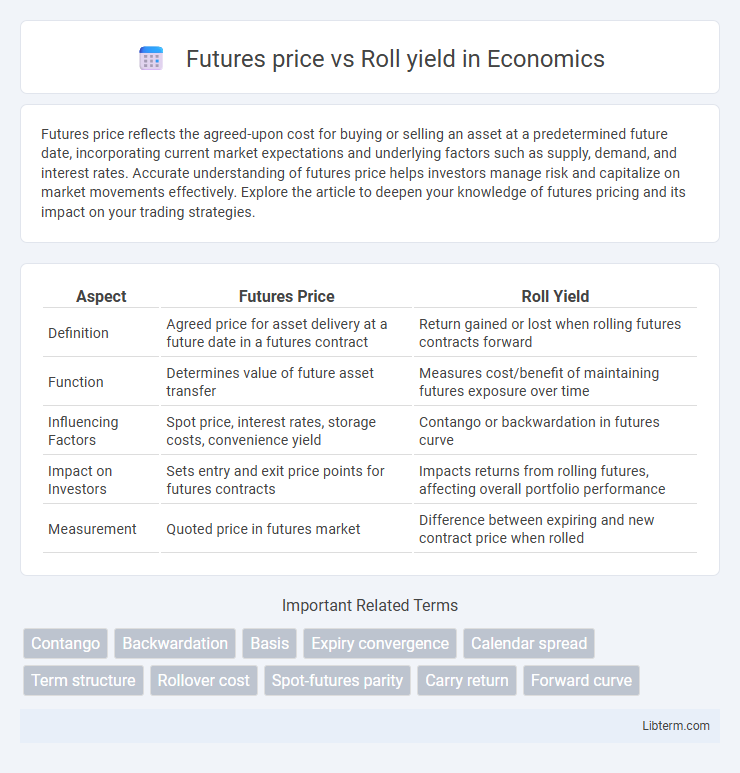

| Aspect | Futures Price | Roll Yield |

|---|---|---|

| Definition | Agreed price for asset delivery at a future date in a futures contract | Return gained or lost when rolling futures contracts forward |

| Function | Determines value of future asset transfer | Measures cost/benefit of maintaining futures exposure over time |

| Influencing Factors | Spot price, interest rates, storage costs, convenience yield | Contango or backwardation in futures curve |

| Impact on Investors | Sets entry and exit price points for futures contracts | Impacts returns from rolling futures, affecting overall portfolio performance |

| Measurement | Quoted price in futures market | Difference between expiring and new contract price when rolled |

Understanding Futures Prices: An Overview

Futures prices reflect the market's expectations of the underlying asset's future value, influenced by factors such as interest rates, storage costs, and supply-demand dynamics. Roll yield arises when investors roll over futures contracts nearing expiration into later-dated contracts, capturing gains or losses due to price differences between contract expirations. Understanding futures prices and roll yield is essential for effectively managing risks and returns in futures trading strategies.

What Is Roll Yield in Futures Trading?

Roll yield in futures trading refers to the gain or loss generated when a trader rolls over a futures contract nearing expiration into a new contract with a later expiration date. This yield arises from the difference between the prices of the expiring contract and the new contract, influenced by the market's contango or backwardation structure. Understanding roll yield is crucial for futures traders because it directly impacts the total return of holding futures positions over time.

Key Differences Between Futures Price and Roll Yield

Futures price represents the contracted value of a commodity or asset for future delivery, reflecting market expectations and supply-demand factors at a specific date. Roll yield arises from the process of rolling over expiring futures contracts into longer-dated contracts, capturing gains or losses due to the futures curve's shape, such as contango or backwardation. Key differences include that futures price is a direct market quote at a point in time, whereas roll yield is an indirect return component influenced by the term structure of futures prices over time.

Factors Influencing Futures Prices

Futures prices are influenced by supply and demand dynamics, interest rates, storage costs, and expectations of future spot prices in the underlying asset market. Roll yield, the return generated from rolling over futures contracts, depends on the shape of the futures curve, whether in contango or backwardation, impacting overall investment performance. Market sentiment, geopolitical events, and seasonal trends also play critical roles in shaping futures prices and subsequently affecting roll yield outcomes.

How Roll Yield Impacts Futures Returns

Roll yield significantly influences futures returns by reflecting the gain or loss from rolling contracts forward in time. When the futures curve is in backwardation, positive roll yield enhances returns as expiring contracts are sold at higher prices than nearby contracts bought. Conversely, contango markets generate negative roll yield, eroding returns due to purchasing futures at higher prices than the expiring contracts.

The Relationship Between Spot Price and Futures Price

The relationship between spot price and futures price is crucial for understanding roll yield, as roll yield arises when futures prices deviate from spot prices during contract rollover. When the futures price is higher than the spot price, known as contango, the roll yield tends to be negative because investors sell cheaper expiring contracts to buy more expensive longer-dated contracts. Conversely, backwardation occurs when the futures price is below the spot price, generating positive roll yield by allowing investors to roll into cheaper contracts than those expiring.

Contango vs. Backwardation: Effects on Roll Yield

In futures markets, contango occurs when futures prices are higher than the expected spot price, resulting in negative roll yield as investors sell near-expiration contracts at lower spot prices and buy longer-dated futures at higher prices. Backwardation happens when futures prices are lower than the expected spot price, generating positive roll yield by allowing investors to roll contracts at a discount compared to the spot price. Understanding the dynamics of contango and backwardation is crucial for managing roll yield effects on total returns in commodity and financial futures investing.

Strategies to Manage Roll Yield Risk

Managing roll yield risk in futures trading requires strategic approaches such as calendar spreads, which involve simultaneously buying and selling futures contracts with different expiration dates to offset adverse roll yield effects. Traders often use curve analysis to identify contango or backwardation in the futures term structure, enabling them to time their entries and exits effectively to minimize negative roll yield impacts. Employing diversification across multiple commodity or financial futures can also reduce exposure to unfavorable roll yield dynamics by balancing gains and losses across assets.

Practical Examples: Futures Price and Roll Yield in Action

Futures price reflects the agreed-upon cost for future delivery of an asset, while roll yield arises from the price difference when rolling over contracts before expiration. For example, in a contango market, investors may experience negative roll yield because they sell cheaper expiring contracts and buy more expensive next-month futures. Conversely, in backwardation, positive roll yield occurs as futures prices decline towards spot price, benefiting holders who roll contracts forward.

Conclusion: Optimizing Returns with Futures and Roll Yield

Maximizing returns in futures trading requires a strategic balance between futures price movements and roll yield, as futures prices reflect market expectations while roll yield captures gains or losses from contract rollovers. Positive roll yield enhances overall performance by benefiting from the shape of the futures curve, often seen in backwardated markets, whereas negative roll yield in contango can erode profits despite favorable price trends. Investors optimize returns by selecting futures contracts and roll schedules aligned with market conditions, leveraging roll yield to complement price appreciation and achieve more consistent gains.

Futures price Infographic

libterm.com

libterm.com