Filtration is a crucial process used to separate solids from liquids or gases, enhancing purity and quality in various industries such as water treatment, pharmaceuticals, and food production. Effective filtration relies on selecting the appropriate filter media and method to efficiently remove contaminants while maintaining optimal flow rates. Discover how mastering filtration techniques can improve your systems by exploring the rest of this article.

Table of Comparison

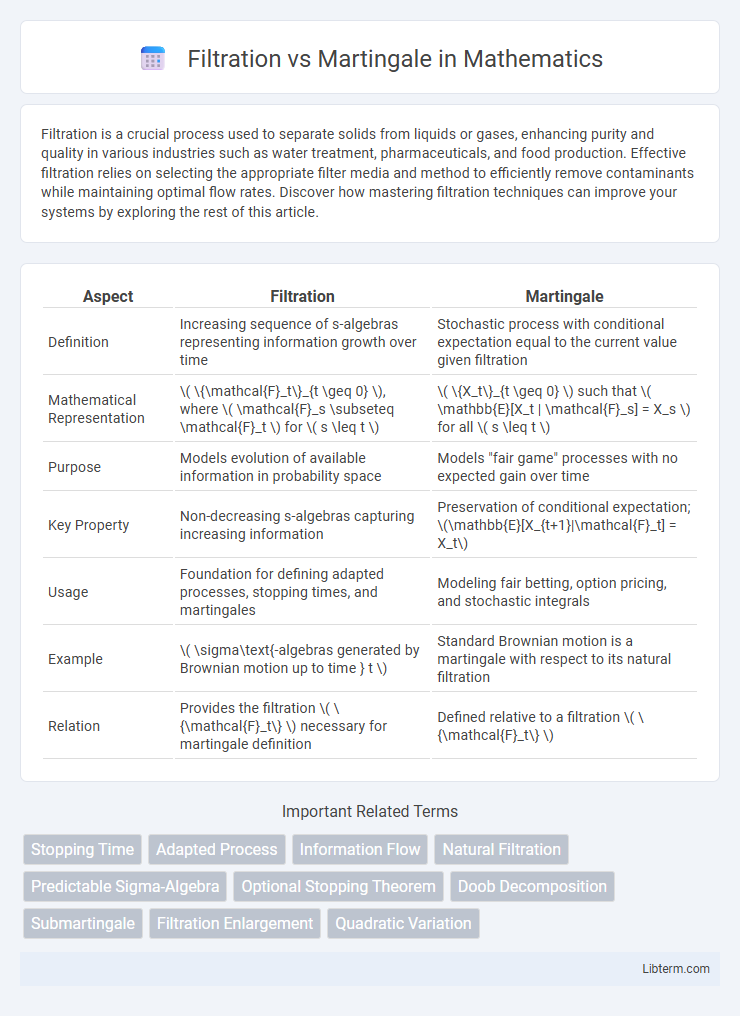

| Aspect | Filtration | Martingale |

|---|---|---|

| Definition | Increasing sequence of s-algebras representing information growth over time | Stochastic process with conditional expectation equal to the current value given filtration |

| Mathematical Representation | \( \{\mathcal{F}_t\}_{t \geq 0} \), where \( \mathcal{F}_s \subseteq \mathcal{F}_t \) for \( s \leq t \) | \( \{X_t\}_{t \geq 0} \) such that \( \mathbb{E}[X_t | \mathcal{F}_s] = X_s \) for all \( s \leq t \) |

| Purpose | Models evolution of available information in probability space | Models "fair game" processes with no expected gain over time |

| Key Property | Non-decreasing s-algebras capturing increasing information | Preservation of conditional expectation; \(\mathbb{E}[X_{t+1}|\mathcal{F}_t] = X_t\) |

| Usage | Foundation for defining adapted processes, stopping times, and martingales | Modeling fair betting, option pricing, and stochastic integrals |

| Example | \( \sigma\text{-algebras generated by Brownian motion up to time } t \) | Standard Brownian motion is a martingale with respect to its natural filtration |

| Relation | Provides the filtration \( \{\mathcal{F}_t\} \) necessary for martingale definition | Defined relative to a filtration \( \{\mathcal{F}_t\} \) |

Understanding Filtration in Stochastic Processes

Filtration in stochastic processes represents the evolving accumulation of information over time, formalized as an increasing family of s-algebras that model observable events up to each time instant. Unlike martingales, which are stochastic processes with conditional expectation properties relative to a filtration, filtration itself sets the informational framework governing these processes. Understanding filtration is crucial for analyzing adapted processes, stopping times, and the structure underlying concepts like martingales and Markov processes in probability theory.

What is the Martingale Concept?

The Martingale concept in probability theory refers to a stochastic process where the conditional expected value of the next observation, given all prior observations, equals the current observation. This model captures the idea of a "fair game," where future values cannot be predicted solely based on past information, reflecting no systematic gain or loss over time. Martingales are fundamental in the study of filtration, as they rely on an increasing sequence of sigma-algebras representing accumulated information and ensure that the process remains unbiased under this filtration.

Core Differences Between Filtration and Martingale

Filtration represents a growing sequence of sigma-algebras capturing the information available over time in a probability space, while a martingale is a stochastic process adapted to this filtration with the property that its conditional expectation at any future time equals its present value. The core difference lies in filtration being a mathematical framework for information flow, whereas a martingale describes a process exhibiting "fair game" behavior relative to that information. Filtrations dictate how martingales evolve, ensuring that martingale increments have zero conditional expectation given the past.

Mathematical Foundations of Filtration

Filtration in probability theory is a mathematical structure representing the evolution of information over time, formalized as an increasing sequence of sigma-algebras on a probability space. This framework underpins the definition of martingales, where a stochastic process's conditional expectation with respect to the filtration remains constant, encapsulating the notion of a "fair game." The rigorous formulation of filtration ensures predictability and adaptability in stochastic processes, enabling precise modeling of random phenomena in fields such as finance and stochastic calculus.

The Role of Filtration in Probability Theory

Filtration in probability theory represents a growing sequence of sigma-algebras that models the accumulation of information over time, essential for defining adapted stochastic processes. It provides the mathematical framework to track the evolution of knowledge, enabling precise formulation of martingales which require conditional expectations relative to the filtration. This structure is fundamental in stochastic analysis, underpinning key concepts like stopping times, optional projections, and the Doob decomposition theorem.

Martingale Properties and Examples

Martingales are stochastic processes characterized by having their conditional expected future values equal to the present value, given all past information encoded in a filtration. Key properties include the martingale property \( E[X_{t+1} | \mathcal{F}_t] = X_t \), fairness of the process without drift, and almost sure convergence under suitable conditions. Examples include the simple symmetric random walk, Brownian motion as a continuous-time martingale with respect to its natural filtration, and the pricing of financial derivatives using martingale measures in risk-neutral valuation.

Compatibility Between Martingales and Filtrations

Martingales are stochastic processes that maintain a conditional expectation equal to the present value given a filtration, ensuring compatibility through the filtration's structure representing available information over time. A filtration is an increasing sequence of sigma-algebras that models the flow of information, making it essential for defining adapted processes like martingales. The compatibility between martingales and filtrations guarantees that a martingale is adapted and its conditional expectations respect the filtration's information hierarchy, enabling rigorous analysis in probability theory and stochastic calculus.

Applications of Filtration and Martingale in Finance

Filtration in finance represents the evolving flow of information over time, enabling accurate modeling of market dynamics and adaptation of trading strategies. Martingales are crucial in option pricing and risk-neutral valuation, where asset prices modeled as martingales ensure fair game conditions and prevent arbitrage opportunities. These concepts underpin derivative pricing, portfolio optimization, and risk management by reflecting realistic information updates and probabilistic behavior of financial assets.

Common Pitfalls and Misconceptions

A common pitfall in understanding filtration versus martingale is confusing filtration with the filtration process in probability spaces; filtration specifically represents an increasing sequence of sigma-algebras modeling the flow of information over time. Misconceptions often include assuming every adapted process with respect to a filtration is a martingale, neglecting the martingale's defining properties of integrability and conditional expectation invariance. Another frequent error arises in ignoring that martingales must be considered relative to a given filtration, as changing the filtration alters their martingale properties fundamentally.

Conclusion: Choosing the Right Concept

Choosing between filtration and martingale depends on the specific application in stochastic processes and financial modeling. Filtration provides a structured way to represent the evolution of information over time, essential for modeling adapted processes and measurable events. Martingales, defined within a given filtration, describe fair game properties and are crucial for pricing derivatives and risk-neutral measures.

Filtration Infographic

libterm.com

libterm.com