A random walk describes a mathematical path consisting of successive random steps, often used to model unpredictable phenomena in finance, physics, and computer science. This concept helps in understanding stock price fluctuations, particle diffusion, and decision-making processes in uncertain environments. Explore the rest of the article to uncover how a random walk can impact your understanding of complex systems.

Table of Comparison

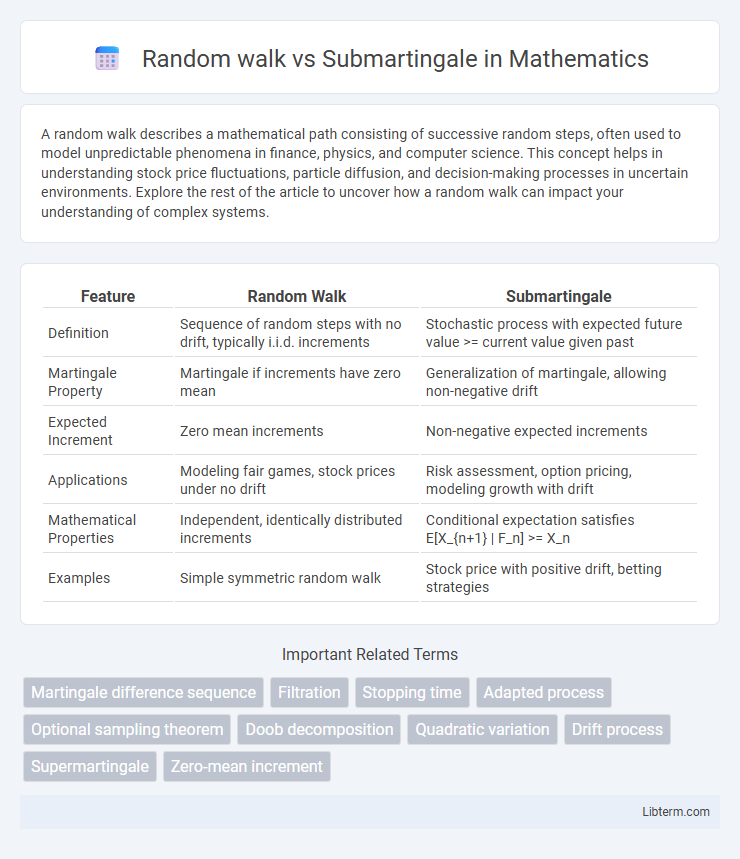

| Feature | Random Walk | Submartingale |

|---|---|---|

| Definition | Sequence of random steps with no drift, typically i.i.d. increments | Stochastic process with expected future value >= current value given past |

| Martingale Property | Martingale if increments have zero mean | Generalization of martingale, allowing non-negative drift |

| Expected Increment | Zero mean increments | Non-negative expected increments |

| Applications | Modeling fair games, stock prices under no drift | Risk assessment, option pricing, modeling growth with drift |

| Mathematical Properties | Independent, identically distributed increments | Conditional expectation satisfies E[X_{n+1} | F_n] >= X_n |

| Examples | Simple symmetric random walk | Stock price with positive drift, betting strategies |

Introduction to Random Walks and Submartingales

Random walks describe sequences of random variables where each step is independent and identically distributed, often modeling unpredictable paths in finance or physics. Submartingales are stochastic processes that, on average, tend to increase over time, satisfying the condition E[X_{n+1} | F_n] >= X_n, representing a non-decreasing expected value with respect to a given filtration. Understanding the fundamental differences between random walks, which exhibit no directional trend, and submartingales, which possess a conditional expected growth property, is crucial in stochastic process theory and applications in areas like option pricing and risk assessment.

Fundamental Concepts: Stochastic Processes

A random walk is a stochastic process where the next value depends on the current value plus a random step, typically representing a path with independent, identically distributed increments. A submartingale is a type of stochastic process characterized by the property that its conditional expected future value is at least as large as the present value, reflecting non-decreasing expected trends. Both concepts are fundamental in probability theory, with random walks modeling unbiased paths and submartingales capturing processes with inherent growth or positive drift.

Defining Random Walks: Characteristics and Examples

Random walks are stochastic processes characterized by sequences of independent, identically distributed random variables representing successive steps, often modeling paths in finance, physics, and biology. Key properties include their Markovian nature, stationary increments, and zero expected drift in simple symmetric cases, such as the classic example of a fair coin toss determining movement direction. Examples include the one-dimensional simple random walk on integers, Brownian motion as its continuous limit, and stock price modeling in the Efficient Market Hypothesis.

Submartingale Process: Formal Definition and Properties

A submartingale is a stochastic process \((X_n)_{n \geq 0}\) adapted to a filtration \((\mathcal{F}_n)_{n \geq 0}\) satisfying the condition \(E[X_{n+1} | \mathcal{F}_n] \geq X_n\) almost surely, indicating non-decreasing conditional expectation over time. Key properties include the preservation of the submartingale condition under positive linear transformations and the Doob decomposition theorem, which expresses any submartingale as the sum of a martingale and an increasing predictable process. Unlike a random walk, which typically has independent and identically distributed increments with zero mean, a submartingale allows for "positive drift," making it a fundamental object in stochastic analysis and finance for modeling processes with expected upward trends.

Mathematical Differences: Random Walk vs Submartingale

A random walk is a stochastic process with independent, identically distributed increments having zero mean, resulting in no systematic upward or downward trend. A submartingale generalizes this by requiring the conditional expectation of the next value to be at least as large as the current value, allowing for a non-negative drift or upward trend over time. Unlike random walks, submartingales incorporate information from the past through the filtration, ensuring the expected future value conditioned on the present is greater than or equal to the current observation.

Applications in Finance and Probability Theory

Random walks model asset price movements with independent, identically distributed increments, essential for option pricing and risk management in finance. Submartingales represent processes with a non-decreasing conditional expectation, underpinning the theory of fair games and optimal stopping problems in probability theory. Both frameworks facilitate the mathematical modeling of market dynamics and decision-making under uncertainty, crucial for portfolio optimization and stochastic analysis.

Key Theorems: Optional Stopping and Martingale Convergence

The Optional Stopping Theorem states that for a submartingale or martingale, the expected value at a stopping time equals the initial value under suitable conditions, highlighting fundamental differences with random walks that may lack this property under arbitrary stopping. Martingale Convergence Theorem ensures that a bounded submartingale converges almost surely to a limit, a critical result not guaranteed for general random walks. These key theorems illustrate how submartingales exhibit more structured long-term behavior compared to random walks, enabling robust probabilistic predictions.

Examples Illustrating Random Walks and Submartingales

Random walks are often illustrated by simple examples like the one-dimensional symmetric random walk where a particle moves one step forward or backward with equal probability, modeling stock price fluctuations or Brownian motion. Submartingales generalize this concept by incorporating a non-negative drift, exemplified by the gambler's wealth process with a favorable betting strategy or the price of a stock expected to increase over time. These examples highlight fundamental differences: random walks exhibit zero expected increments, whereas submartingales maintain non-decreasing expected values conditional on past information.

Advantages and Limitations of Each Model

Random walks offer simplicity and intuitive modeling of fair game scenarios with independent, identically distributed increments, providing clear analytical tractability in many stochastic processes. Submartingales extend this framework by incorporating conditional expectation properties that allow for modeling processes with an inherent drift or growth tendency, enhancing their applicability in finance and risk assessment. Limitations of random walks include their inability to capture trends or dependence structures, while submartingales can be mathematically complex and require stricter conditions to ensure convergence and interpretability.

Conclusion: Choosing Between Random Walks and Submartingales

Random walks exhibit symmetric, unbiased behavior with independent increments, making them ideal for modeling purely stochastic processes without drift. Submartingales incorporate a non-decreasing expected value, capturing scenarios with inherent growth or positive trends, which suits financial modeling and risk assessment involving upward momentum. Selecting between random walks and submartingales hinges on whether the process reflects true randomness or includes a predictive tendency towards increase.

Random walk Infographic

libterm.com

libterm.com