Deferred tax arises from temporary differences between accounting income and taxable income, impacting financial statements and tax liabilities. Understanding its calculation and effects on your company's financial health is crucial for effective tax planning and compliance. Explore the rest of the article to learn how deferred tax can influence your business strategy and reporting.

Table of Comparison

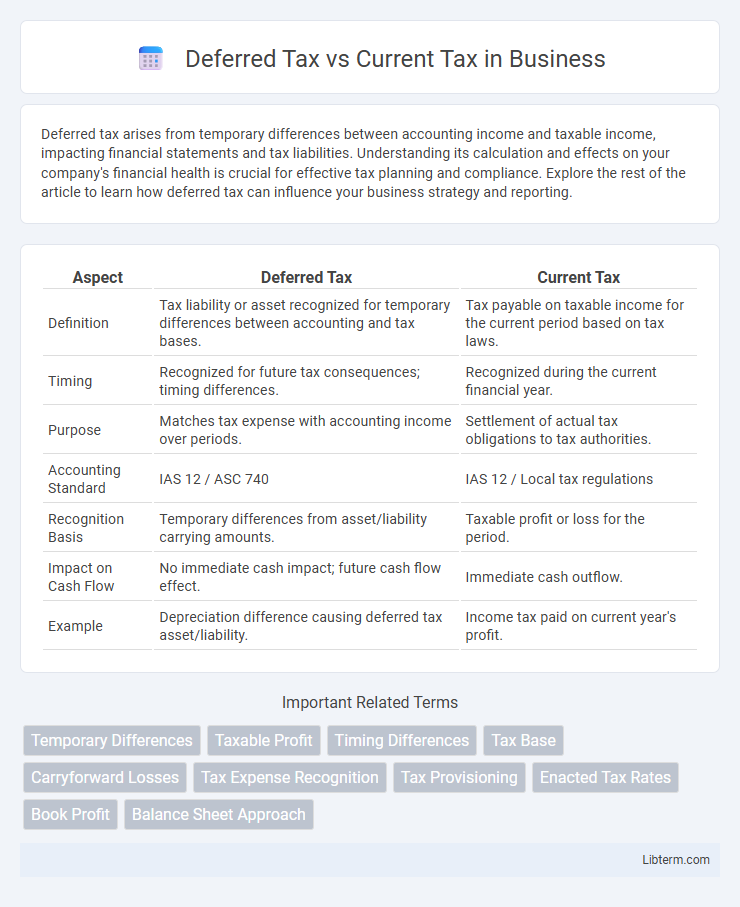

| Aspect | Deferred Tax | Current Tax |

|---|---|---|

| Definition | Tax liability or asset recognized for temporary differences between accounting and tax bases. | Tax payable on taxable income for the current period based on tax laws. |

| Timing | Recognized for future tax consequences; timing differences. | Recognized during the current financial year. |

| Purpose | Matches tax expense with accounting income over periods. | Settlement of actual tax obligations to tax authorities. |

| Accounting Standard | IAS 12 / ASC 740 | IAS 12 / Local tax regulations |

| Recognition Basis | Temporary differences from asset/liability carrying amounts. | Taxable profit or loss for the period. |

| Impact on Cash Flow | No immediate cash impact; future cash flow effect. | Immediate cash outflow. |

| Example | Depreciation difference causing deferred tax asset/liability. | Income tax paid on current year's profit. |

Introduction to Deferred Tax and Current Tax

Deferred tax represents liabilities or assets arising from temporary differences between accounting income and taxable income, reflecting future tax consequences of current transactions. Current tax refers to the amount of income tax payable or recoverable for the current period based on taxable income calculated under tax laws. Understanding the distinction ensures accurate financial reporting and compliance with accounting standards like IAS 12.

Definition of Deferred Tax

Deferred tax represents the tax effects of temporary differences between the carrying amount of assets and liabilities in the financial statements and their tax bases, arising due to timing differences in recognizing income and expenses. This liability or asset reflects future tax consequences of transactions already recognized in accounting but not yet in tax returns, such as depreciation or revenue recognition discrepancies. Unlike current tax, which measures the tax payable or recoverable for the current period based on taxable income, deferred tax accounts for postponed tax obligations or benefits expected to affect future periods.

Definition of Current Tax

Current tax refers to the amount of income tax payable or recoverable for the current period based on taxable profit calculated according to tax laws and regulations. It represents the actual tax liability or refund due to the tax authorities for the current fiscal year, excluding any adjustments for prior periods or future tax effects. Current tax is recognized in the financial statements as a liability if payable or as an asset if refundable.

Key Differences Between Deferred Tax and Current Tax

Deferred tax arises from temporary differences between accounting income and taxable income, impacting future tax liabilities or assets, while current tax is the actual tax payable or receivable for the current fiscal year based on taxable income. Deferred tax is recognized on the balance sheet as a liability or asset, reflecting timing differences, whereas current tax is recorded on the income statement as an expense or benefit. Key differences include the timing of recognition, with deferred tax relating to future periods and current tax relating to the present period's tax obligations.

Recognition Criteria for Deferred Tax

Deferred tax is recognized based on temporary differences between the carrying amount of assets and liabilities in the financial statements and their tax bases, as outlined in IAS 12. Current tax is determined by taxable profit or loss for the period according to tax laws and regulations, while deferred tax arises due to timing differences expected to reverse in future periods. Recognition criteria for deferred tax require identifiable temporary differences, recoverable or payable tax consequences, and reasonable certainty of realization or settlement.

Recognition Criteria for Current Tax

Current tax is recognized based on taxable profit or loss for the period as per tax laws applicable to the reporting entity. Recognition criteria require measurement of tax payable or recoverable using the enacted or substantively enacted tax rates at the end of the reporting period. Deferred tax arises from temporary differences between the carrying amount of assets and liabilities for financial reporting purposes and their tax bases, while current tax reflects the actual tax obligations or refunds for the current period.

Impact of Deferred Tax on Financial Statements

Deferred tax represents the future tax effects of temporary differences between accounting income and taxable income, impacting the balance sheet through deferred tax assets and liabilities. These deferred tax balances adjust equity by recognizing postponed tax expenses or benefits, influencing net income indirectly over time. Accurate accounting for deferred tax ensures a more precise presentation of a company's financial position and future tax obligations.

Impact of Current Tax on Financial Statements

Current tax directly affects the income statement by reducing net profit through tax expenses based on taxable income reported for the period. On the balance sheet, current tax liabilities or assets represent amounts owed or refundable to tax authorities, impacting the working capital and liquidity positions. Precise measurement and disclosure of current tax enhance the accuracy of financial statements and provide stakeholders with clear insight into the company's tax obligations.

Examples Illustrating Deferred and Current Tax

Deferred tax arises from timing differences between accounting income and taxable income, such as when revenue is recognized in the books before it is taxable or when expenses are deductible in different periods for tax and accounting purposes. For example, if a company uses accelerated depreciation for tax purposes but straight-line depreciation in its financial statements, it creates a deferred tax liability or asset. Current tax refers to the amount of income tax payable or recoverable for the current period based on taxable income, like the tax due on profits calculated using the applicable tax rate and reported in the current tax expense.

Conclusion: Significance for Financial Reporting

Deferred tax represents future tax liabilities or assets arising from temporary differences between accounting income and taxable income, while current tax reflects the actual tax payable or receivable for the current period. Accurate recognition and disclosure of both deferred and current tax are crucial for transparent financial reporting, ensuring stakeholders understand a company's true tax obligations and financial position. Proper tax accounting enhances compliance with accounting standards such as IAS 12 and improves the reliability of financial statements for decision-making.

Deferred Tax Infographic

libterm.com

libterm.com