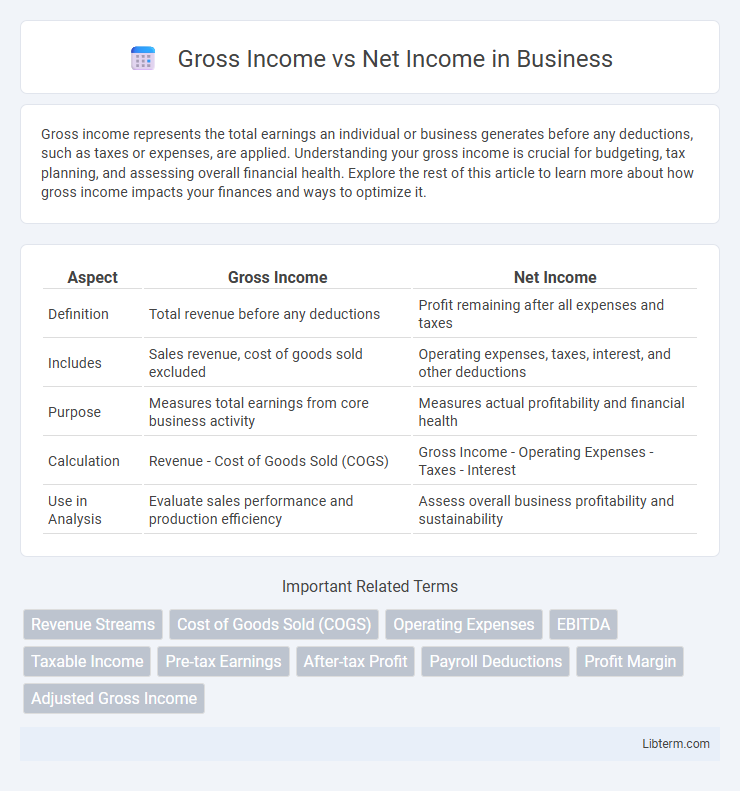

Gross income represents the total earnings an individual or business generates before any deductions, such as taxes or expenses, are applied. Understanding your gross income is crucial for budgeting, tax planning, and assessing overall financial health. Explore the rest of this article to learn more about how gross income impacts your finances and ways to optimize it.

Table of Comparison

| Aspect | Gross Income | Net Income |

|---|---|---|

| Definition | Total revenue before any deductions | Profit remaining after all expenses and taxes |

| Includes | Sales revenue, cost of goods sold excluded | Operating expenses, taxes, interest, and other deductions |

| Purpose | Measures total earnings from core business activity | Measures actual profitability and financial health |

| Calculation | Revenue - Cost of Goods Sold (COGS) | Gross Income - Operating Expenses - Taxes - Interest |

| Use in Analysis | Evaluate sales performance and production efficiency | Assess overall business profitability and sustainability |

Understanding Gross Income

Gross income represents the total earnings a person or business receives before any deductions such as taxes, social security, or retirement contributions. This figure includes wages, bonuses, rental income, and any other sources of revenue, providing a comprehensive overview of overall financial inflow. Understanding gross income is essential for budgeting, tax calculations, and evaluating true earning potential.

Defining Net Income

Net income represents the actual profit a company retains after deducting all expenses, taxes, and costs from its gross income. This key financial metric reflects the true profitability and is essential for assessing business performance, as opposed to gross income, which shows total revenue without expense considerations. Investors and analysts rely on net income to determine a company's financial health and its ability to generate sustainable earnings.

Key Differences Between Gross and Net Income

Gross income represents the total revenue earned before any expenses or deductions are applied, reflecting the overall financial inflow. Net income, also known as profit or bottom line, is the amount remaining after all operating expenses, taxes, interest, and other costs have been subtracted from gross income. The key difference lies in gross income showing total earnings, while net income provides a clear picture of actual profitability and financial health.

How to Calculate Gross Income

Gross income is calculated by summing all earnings before any deductions, including wages, bonuses, rental income, and investment returns. To accurately compute gross income, add up total revenues from all sources during the specified period, excluding taxes and expenses. This figure serves as the foundation for financial analysis and tax reporting before subtracting costs to determine net income.

How to Calculate Net Income

Net income is calculated by subtracting all expenses, including operating costs, taxes, interest, and depreciation, from gross income, which is the total revenue earned before any deductions. Accurate calculation of net income requires detailed accounting of all income sources and thorough tracking of all expenditures. This figure represents the actual profitability of a business or individual after all financial obligations are met.

Components Included in Gross Income

Gross income encompasses total earnings before any deductions and includes components such as wages, salaries, bonuses, rental income, interest, dividends, and business revenue. It reflects all income sources subject to taxation before subtracting expenses like taxes, retirement contributions, and insurance premiums. Understanding these components is essential for accurate financial analysis and tax reporting.

Deductions Affecting Net Income

Deductions affecting net income include taxes, retirement contributions, health insurance premiums, and other withholdings like social security and Medicare. These deductions reduce gross income to derive the actual take-home pay an individual receives. Understanding these factors is essential for accurate financial planning and assessing true earnings.

Importance in Personal Finance

Gross income represents total earnings before deductions, while net income reflects the actual amount available after taxes and expenses. Understanding net income is crucial for budgeting, saving, and managing personal finances effectively. Accurate knowledge of both income types helps individuals make informed financial decisions and plan for future financial stability.

Implications for Business and Taxation

Gross income represents total revenue earned by a business before any expenses are deducted, serving as a key indicator of overall sales performance. Net income, calculated after subtracting costs, operating expenses, interest, and taxes, reflects the true profitability and financial health of a company. Accurate differentiation between gross and net income is essential for tax reporting, business valuation, and strategic decision-making, impacting tax liabilities and investment prospects.

Gross Income vs Net Income: Which Matters More?

Gross income represents total earnings before any deductions, while net income reflects the actual take-home pay after taxes and expenses. Net income matters more for personal finance decisions, budgeting, and determining true profitability. Understanding the distinction helps individuals and businesses evaluate financial health and plan more effectively.

Gross Income Infographic

libterm.com

libterm.com