An Initial Public Offering (IPO) marks the first time a private company offers its shares to the public, unlocking access to capital markets and enhancing its growth potential. Understanding the IPO process, including valuation, regulatory requirements, and market conditions, is crucial for investors aiming to make informed decisions. Discover the key insights about IPOs and how they can impact Your investment strategy in the rest of this article.

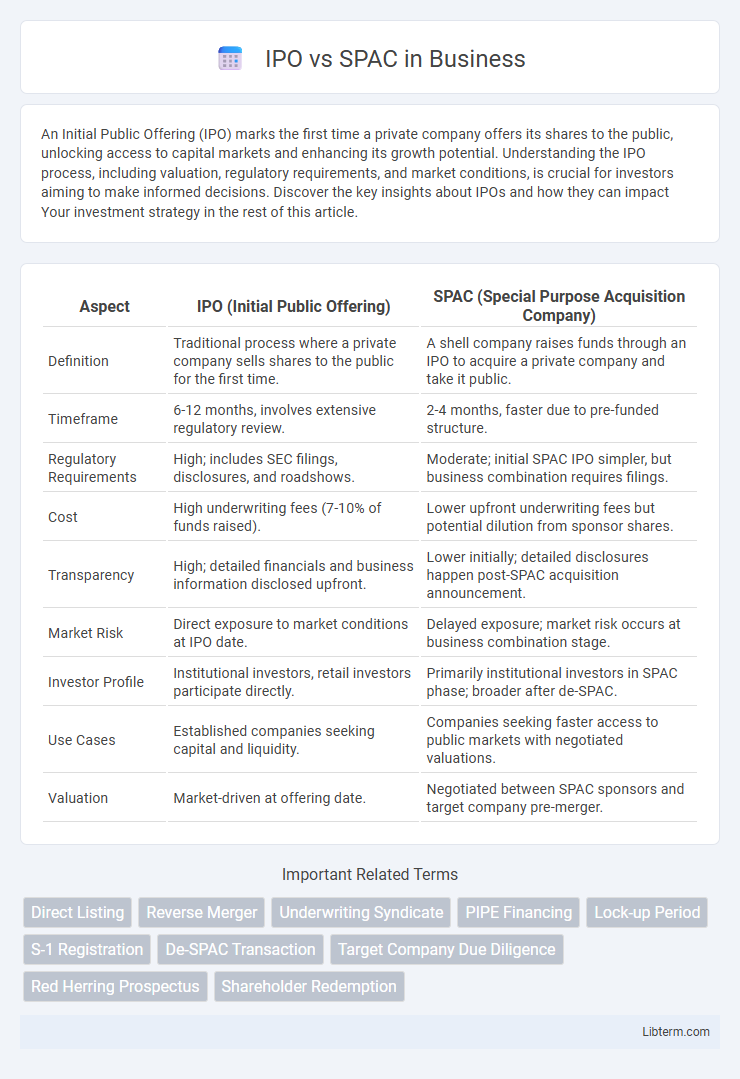

Table of Comparison

| Aspect | IPO (Initial Public Offering) | SPAC (Special Purpose Acquisition Company) |

|---|---|---|

| Definition | Traditional process where a private company sells shares to the public for the first time. | A shell company raises funds through an IPO to acquire a private company and take it public. |

| Timeframe | 6-12 months, involves extensive regulatory review. | 2-4 months, faster due to pre-funded structure. |

| Regulatory Requirements | High; includes SEC filings, disclosures, and roadshows. | Moderate; initial SPAC IPO simpler, but business combination requires filings. |

| Cost | High underwriting fees (7-10% of funds raised). | Lower upfront underwriting fees but potential dilution from sponsor shares. |

| Transparency | High; detailed financials and business information disclosed upfront. | Lower initially; detailed disclosures happen post-SPAC acquisition announcement. |

| Market Risk | Direct exposure to market conditions at IPO date. | Delayed exposure; market risk occurs at business combination stage. |

| Investor Profile | Institutional investors, retail investors participate directly. | Primarily institutional investors in SPAC phase; broader after de-SPAC. |

| Use Cases | Established companies seeking capital and liquidity. | Companies seeking faster access to public markets with negotiated valuations. |

| Valuation | Market-driven at offering date. | Negotiated between SPAC sponsors and target company pre-merger. |

Introduction to IPOs and SPACs

An Initial Public Offering (IPO) allows a private company to raise capital by offering shares directly to the public through stock exchanges, ensuring regulatory transparency and investor scrutiny. Special Purpose Acquisition Companies (SPACs) are shell companies formed specifically to merge with private firms, providing faster public market access without the traditional IPO process. Both methods serve as paths to public markets but differ in structure, timeline, and regulatory requirements.

What Is an IPO?

An Initial Public Offering (IPO) is a process where a private company offers its shares to the public for the first time to raise capital for expansion, debt repayment, or other corporate purposes. This traditional method involves rigorous regulatory scrutiny, including filing extensive financial disclosures with the Securities and Exchange Commission (SEC), ensuring transparency and investor protection. IPOs typically attract institutional investors and demand a longer timeline compared to alternative methods like Special Purpose Acquisition Companies (SPACs).

What Is a SPAC?

A Special Purpose Acquisition Company (SPAC) is a shell corporation listed on a stock exchange with the purpose of acquiring a private company, thereby taking it public without the traditional Initial Public Offering (IPO) process. SPACs offer a faster route to public markets by merging with a target company, providing capital infusion and streamlined regulatory approvals. Investors in SPACs benefit from predefined acquisition timelines and the ability to redeem shares if the deal does not materialize.

IPO vs SPAC: Key Differences

IPO involves a company offering shares directly to the public through a regulated stock exchange, providing transparency and price discovery via underwriters. SPAC, or Special Purpose Acquisition Company, raises capital through an initial public offering without operating assets, aiming to merge with a private company to facilitate a faster route to public markets. Key differences include timeline efficiency, regulatory scrutiny, and valuation methods, with IPOs typically taking longer but ensuring thorough due diligence, while SPACs offer speed and certainty but may involve higher investor risk.

Process Comparison: IPO vs SPAC

The IPO process involves a company working closely with underwriters, filing a detailed registration statement with the SEC, and undergoing extensive scrutiny before shares are offered to the public. In contrast, SPACs allow companies to go public by merging with an already listed shell company, significantly reducing regulatory hurdles and time to market. This streamlined approach often results in faster capital access but may carry higher risks due to less rigorous initial disclosures compared to traditional IPOs.

Speed and Efficiency in Going Public

SPACs typically offer a faster route to going public, often completing the process within 3 to 6 months, compared to traditional IPOs that can take 6 to 12 months or longer due to regulatory scrutiny and extensive due diligence. The streamlined structure of SPAC mergers reduces the complexity and time involved in pricing, roadshows, and market conditions inherent in IPOs. This efficiency allows companies to access capital markets quickly while adapting to volatile market environments.

Cost Analysis: IPOs vs SPACs

Initial Public Offerings (IPOs) typically involve higher underwriting fees, averaging 7% of the capital raised, along with extensive regulatory compliance costs and longer preparation times. Special Purpose Acquisition Companies (SPACs) often incur lower upfront expenses and reduced marketing efforts but may result in higher long-term costs due to sponsor shares dilution and post-merger integration expenses. A comprehensive cost analysis must factor in both immediate fees and potential value erosion when comparing IPOs versus SPACs.

Regulatory Scrutiny and Transparency

IPOs undergo rigorous regulatory scrutiny by the SEC, requiring detailed disclosures through the S-1 registration statement to ensure transparency for investors. SPACs, while also regulated, have a streamlined process with fewer initial disclosure requirements, often leading to concerns about transparency until the acquisition target is announced. This difference results in IPOs typically providing greater upfront investor clarity, whereas SPACs rely on post-merger disclosures to meet transparency standards.

Risks and Challenges of IPOs and SPACs

IPOs face risks such as high regulatory scrutiny, lengthy approval processes, and market volatility that can impact initial share prices. SPACs encounter challenges including potential misalignment of incentives between sponsors and investors, lack of transparency, and time constraints to complete acquisitions. Both IPOs and SPACs expose investors to valuation uncertainties and post-listing performance risks.

Which Is Better: IPO or SPAC?

An Initial Public Offering (IPO) offers companies a tested, transparent route to public markets with regulatory scrutiny that can build investor confidence and long-term valuation stability. Special Purpose Acquisition Companies (SPACs) provide a faster, less traditional alternative, allowing firms to merge with a pre-established shell company and expedite the listing process, often appealing to startups seeking quick capital inflows. The choice depends on company priorities: IPOs suit firms valuing investor trust and thorough disclosure, while SPACs appeal to those prioritizing speed and reduced market uncertainty.

IPO Infographic

libterm.com

libterm.com