Hartwick's Rule emphasizes that to maintain a constant level of wealth over time, society must invest all rents earned from exhaustible resources into productive capital. This principle ensures sustainable economic development by balancing resource depletion with capital accumulation. Discover how applying Hartwick's Rule can secure Your long-term prosperity throughout this article.

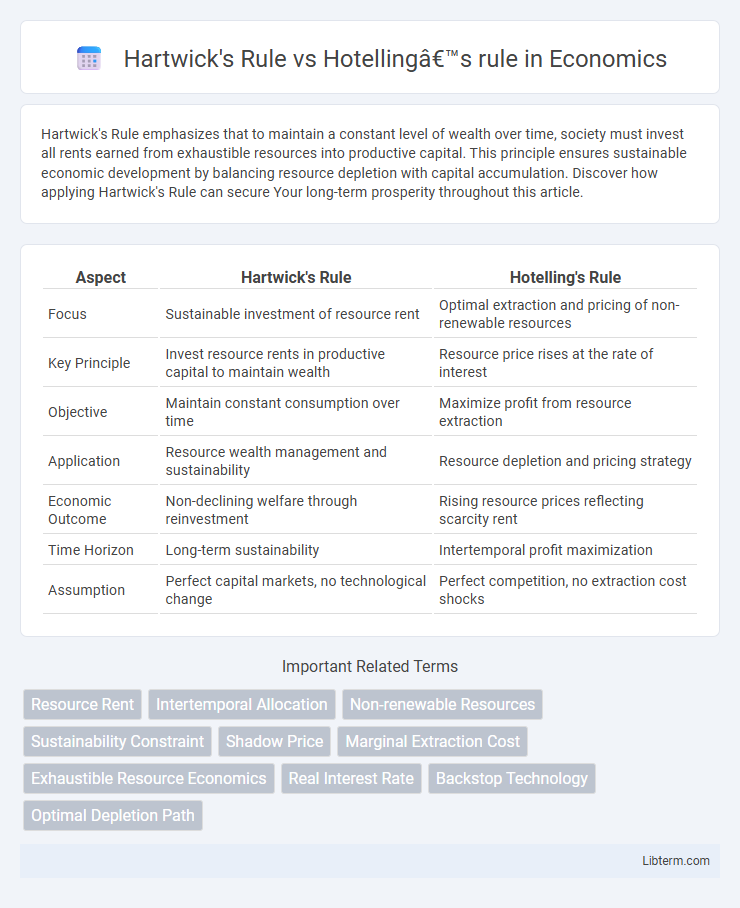

Table of Comparison

| Aspect | Hartwick's Rule | Hotelling's Rule |

|---|---|---|

| Focus | Sustainable investment of resource rent | Optimal extraction and pricing of non-renewable resources |

| Key Principle | Invest resource rents in productive capital to maintain wealth | Resource price rises at the rate of interest |

| Objective | Maintain constant consumption over time | Maximize profit from resource extraction |

| Application | Resource wealth management and sustainability | Resource depletion and pricing strategy |

| Economic Outcome | Non-declining welfare through reinvestment | Rising resource prices reflecting scarcity rent |

| Time Horizon | Long-term sustainability | Intertemporal profit maximization |

| Assumption | Perfect capital markets, no technological change | Perfect competition, no extraction cost shocks |

Introduction to Resource Economics

Hartwick's Rule emphasizes reinvesting rents from exhaustible resources into productive capital to sustain consumption over time, ensuring intergenerational equity. Hotelling's Rule states that the net price of a non-renewable resource should rise at the rate of interest, reflecting resource scarcity and guiding optimal extraction rates. Both principles are foundational in resource economics for managing depletion and promoting sustainable economic growth.

Defining Hartwick's Rule

Hartwick's Rule defines a sustainable consumption path in nonrenewable resource economics by stating that investing all rents from exhaustible resource extraction into reproducible capital maintains constant consumption over time. It contrasts with Hotelling's Rule, which emphasizes the optimal exhaustion path and price trajectory of the resource itself, predicting that resource prices should rise at the rate of interest. Hartwick's framework ensures long-term welfare by converting resource wealth into productive capital, preventing depletion from reducing future consumption possibilities.

Understanding Hotelling’s Rule

Hotelling's Rule explains how the price of a non-renewable resource is expected to increase at the rate of interest over time, reflecting the opportunity cost of depleting finite reserves today rather than in the future. It assumes efficient markets and scarcity, guiding optimal resource extraction by balancing current profits against future scarcity rents. Understanding Hotelling's Rule is crucial for natural resource economics, investment strategies in mineral and fossil fuel sectors, and governmental policy on resource conservation.

Mathematical Formulations

Hartwick's Rule is mathematically expressed as investing the rents from exhaustible resources into reproducible capital to sustain constant consumption, typically formulated as \(\dot{K} = R - C\), where \(K\) is capital stock, \(R\) resource rents, and \(C\) consumption, ensuring non-declining welfare over time. Hotelling's Rule provides a dynamic pricing model for non-renewable resources, stating that the net price \(p_t\) rises at the rate of interest \(r\), expressed as \(\frac{dp_t}{dt} = r p_t\), guiding optimal resource extraction paths. Both rules integrate economic growth and resource depletion through differential equations but emphasize different conservation strategies: Hartwick's focuses on sustainable investment, Hotelling's on efficient extraction pricing.

Assumptions Behind Each Rule

Hartwick's Rule assumes a constant rate of resource extraction paired with investing all rents into reproducible capital to maintain consumption levels over time. Hotelling's Rule assumes a non-renewable resource is extracted optimally with prices rising at the rate of interest, reflecting scarcity and opportunity cost. Both models rely on perfect competition, no technological change, and infinite future horizons in resource management economics.

Economic Implications for Resource Management

Hartwick's Rule guides sustainable consumption by recommending investment of resource rents into productive capital to maintain constant consumption over time, ensuring intergenerational equity. Hotelling's Rule emphasizes that non-renewable resource prices should increase at the rate of interest, reflecting scarcity and incentivizing efficient extraction. Combining these principles helps policymakers balance resource depletion with economic growth, optimizing long-term resource management and sustainability.

Comparison: Sustainability Perspective

Hartwick's Rule emphasizes reinvestment of resource rents into productive capital to maintain constant consumption over time, promoting sustainable economic welfare despite resource depletion. Hotelling's Rule focuses on the optimal extraction rate ensuring the resource price grows at the rate of interest, guiding efficient resource depletion but not explicitly addressing reinvestment for sustainability. From a sustainability perspective, Hartwick's Rule provides a more comprehensive framework by ensuring wealth transformation, whereas Hotelling's Rule targets intertemporal price efficiency without guaranteeing long-term welfare preservation.

Policy Applications and Limitations

Hartwick's Rule guides policymakers in sustainable resource management by recommending reinvestment of resource rents into productive capital to maintain constant consumption over time, effectively balancing non-renewable resource depletion and economic growth. Hotelling's Rule informs extraction policies by suggesting resource prices should rise at the rate of interest, which helps determine optimal depletion schedules but assumes perfect market conditions and ignores technological changes. Both frameworks face limitations in practical policy application due to uncertainties in resource availability, market imperfections, and socio-environmental factors affecting long-term sustainability.

Real-World Case Studies

Hartwick's Rule emphasizes sustainable consumption by investing rents from exhaustible resources into productive capital, demonstrated by Norway's sovereign wealth fund which channels oil revenues into diversified assets ensuring long-term economic stability. Hotelling's Rule focuses on optimal extraction rates to maximize resource value over time, illustrated by the diminishing reserves and rising prices of global oil fields, where producers adjust output in response to price trajectories. Comparing both in practice reveals how resource-rich nations balance consumption and conservation, with Norway exemplifying Hartwick's approach while traditional oil exporters align extraction policies with Hotelling's framework.

Conclusion and Future Directions

Hartwick's Rule ensures sustainable consumption by investing resource rents into reproducible capital, maintaining constant utility over time, whereas Hotelling's Rule guides optimal extraction paths based on resource scarcity and price increases. Integrating both rules could enhance resource management by balancing economic efficiency with sustainability goals. Future research may explore dynamic models combining Hartwick's constant utility focus with Hotelling's price trajectory insights under environmental and technological uncertainties.

Hartwick's Rule Infographic

libterm.com

libterm.com