Mezzanine debt is a hybrid form of financing that combines elements of both debt and equity, typically used by companies to fund growth or acquisitions without diluting ownership significantly. It usually carries higher interest rates due to its subordinate position in the capital structure, but it offers lenders potential equity participation through warrants or conversion options. Discover how mezzanine debt can strategically boost your company's capital structure and growth potential in the rest of this article.

Table of Comparison

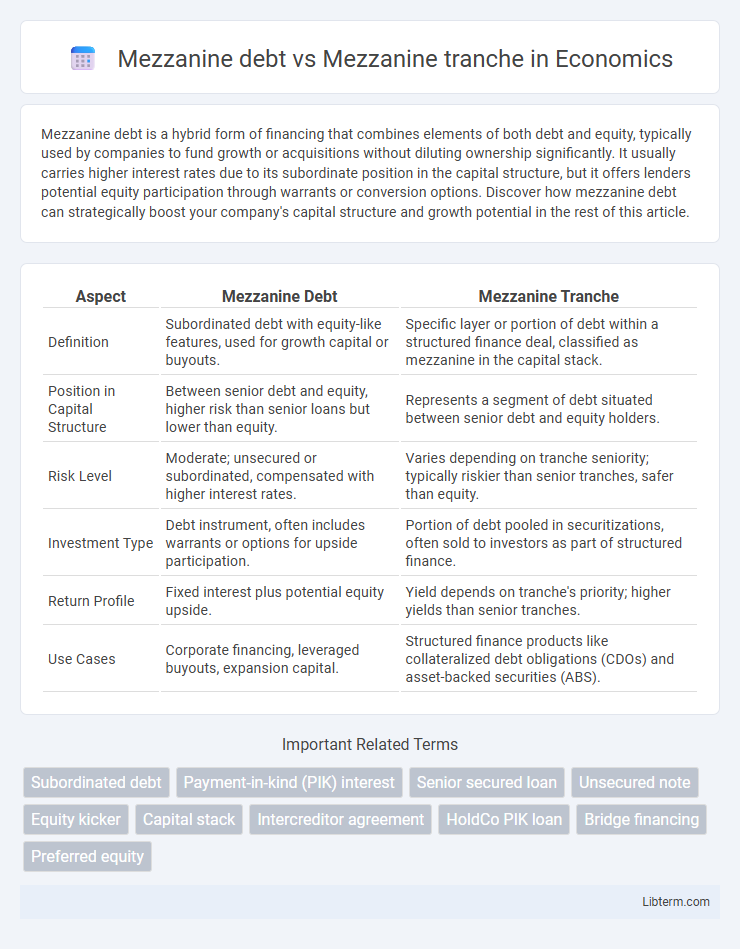

| Aspect | Mezzanine Debt | Mezzanine Tranche |

|---|---|---|

| Definition | Subordinated debt with equity-like features, used for growth capital or buyouts. | Specific layer or portion of debt within a structured finance deal, classified as mezzanine in the capital stack. |

| Position in Capital Structure | Between senior debt and equity, higher risk than senior loans but lower than equity. | Represents a segment of debt situated between senior debt and equity holders. |

| Risk Level | Moderate; unsecured or subordinated, compensated with higher interest rates. | Varies depending on tranche seniority; typically riskier than senior tranches, safer than equity. |

| Investment Type | Debt instrument, often includes warrants or options for upside participation. | Portion of debt pooled in securitizations, often sold to investors as part of structured finance. |

| Return Profile | Fixed interest plus potential equity upside. | Yield depends on tranche's priority; higher yields than senior tranches. |

| Use Cases | Corporate financing, leveraged buyouts, expansion capital. | Structured finance products like collateralized debt obligations (CDOs) and asset-backed securities (ABS). |

Introduction to Mezzanine Financing

Mezzanine debt represents a hybrid financing instrument combining elements of debt and equity, positioned between senior debt and equity in a company's capital structure. A mezzanine tranche refers to the specific portion of a financing structure that includes this subordinated debt, often used in leveraged buyouts and growth capital to bridge the gap between secured loans and equity. This form of financing offers higher returns due to increased risk, often including warrants or options to convert debt into equity.

What is Mezzanine Debt?

Mezzanine debt is a hybrid form of financing that combines features of both debt and equity, typically used by companies to fund expansion or acquisitions with higher risk tolerance. It sits between senior debt and equity in the capital structure, offering lenders higher interest rates and potential equity participation through warrants or options. Mezzanine debt provides subordinated capital that enhances leverage without diluting ownership like equity financing, making it a flexible alternative for growth-oriented businesses.

Defining Mezzanine Tranche

A mezzanine tranche refers to a specific layer within a structured finance deal, positioned between senior debt and equity, typically carrying moderate risk and higher returns than senior tranches. Mezzanine debt represents subordinated financing that blends debt and equity features, often used for growth capital with interest payments and potential equity conversion. The mezzanine tranche specifically segments the risk and return profile in securitized structures, crucial for investors balancing yield and credit exposure.

Key Features of Mezzanine Debt

Mezzanine debt is a hybrid form of financing that blends elements of debt and equity, typically used by companies to fund expansion without diluting ownership. Key features include subordinated status below senior debt, higher interest rates reflecting increased risk, and embedded equity components such as warrants or options. Mezzanine tranche refers to the specific segment of a structured finance product containing mezzanine debt, carrying medium risk and yield, positioned between senior and equity tranches in the capital structure.

Structural Elements of a Mezzanine Tranche

The mezzanine tranche in a financing structure represents a layer of subordinated debt positioned between senior debt and equity, featuring higher risk and return profiles compared to senior loans. Structural elements of a mezzanine tranche include its position in the capital stack, interest rate provisions often comprising a fixed coupon plus payment-in-kind (PIK) interest, and covenants that are typically less restrictive than those on senior debt but more so than equity. Mezzanine debt within this tranche commonly includes warrants or equity kickers that provide additional upside potential to lenders, aligning risk and reward in leveraged buyouts and structured finance transactions.

Similarities Between Mezzanine Debt and Tranche

Mezzanine debt and mezzanine tranche both represent subordinated layers of financing positioned between senior debt and equity within a company's capital structure. They share characteristics such as higher risk profiles, flexible repayment terms, and the potential for conversion into equity or warrants, aligning investor interests with company growth. Both serve as crucial tools for bridging funding gaps, supporting leveraged buyouts, and enabling business expansion while offering attractive returns above traditional debt instruments.

Critical Differences: Debt vs. Tranche

Mezzanine debt refers to a hybrid financing instrument that combines elements of equity and debt, typically used in leveraged buyouts or growth capital where it ranks below senior debt but above equity in the capital structure. A mezzanine tranche, by contrast, is a specific segment or layer of a structured finance product, such as collateralized debt obligations (CDOs) or mortgage-backed securities (MBS), representing the middle risk and return portion between senior and equity tranches. The critical difference lies in mezzanine debt being a standalone, subordinated loan or security, while a mezzanine tranche is part of a sliced pool of securities within a securitized asset offering distinct risk profiles within the broader capital stack.

Pros and Cons of Mezzanine Debt

Mezzanine debt provides companies with flexible financing options, often combining debt and equity features, allowing for higher leverage without immediate equity dilution. Its main advantages include subordinated status that enables access to capital beyond traditional loans and potential tax-deductible interest payments; however, it usually carries higher interest rates and increased risk for lenders compared to senior debt. Mezzanine tranche refers to the specific portion of a securitized debt structure featuring medium risk and return, but investing in mezzanine debt requires balancing benefits of growth capital against the costs of higher interest and possible loss of control through equity kickers.

Risks and Benefits of Mezzanine Tranche

Mezzanine tranche refers to the middle layer of debt in a structured finance deal, positioned between senior debt and equity, carrying higher interest rates to compensate for increased risk. The main risks of mezzanine tranches include higher default risk and lower priority in case of liquidation compared to senior debt, while the benefits involve attractive returns and potential equity participation. Investors in mezzanine tranches gain from increased yield relative to senior loans but must carefully assess credit risk and liquidity constraints inherent to this debt layer.

Choosing Between Mezzanine Debt and Mezzanine Tranche

Mezzanine debt represents a hybrid of debt and equity financing, providing lenders with fixed interest payments plus potential equity upside, often used by companies seeking growth capital without diluting ownership significantly. Mezzanine tranche refers to a portion of a structured finance instrument like collateralized debt obligations (CDOs), where this tranche carries moderate risk and yields higher returns compared to senior tranches, attracting investors with specific risk tolerance. Choosing between mezzanine debt and mezzanine tranche depends on the investor's risk appetite, desired return profile, and the underlying credit quality, with mezzanine debt suited for direct company financing and mezzanine tranches aligned with structured product strategies.

Mezzanine debt Infographic

libterm.com

libterm.com