A supermartingale is a sequence of random variables where the expected future value, given all prior information, is always less than or equal to the current value, reflecting a process that tends to decrease or remain stable over time. This concept is crucial in fields like finance and probability theory for modeling fair games and risk assessment. Discover how understanding supermartingales can enhance your approach to stochastic processes and decision-making throughout this article.

Table of Comparison

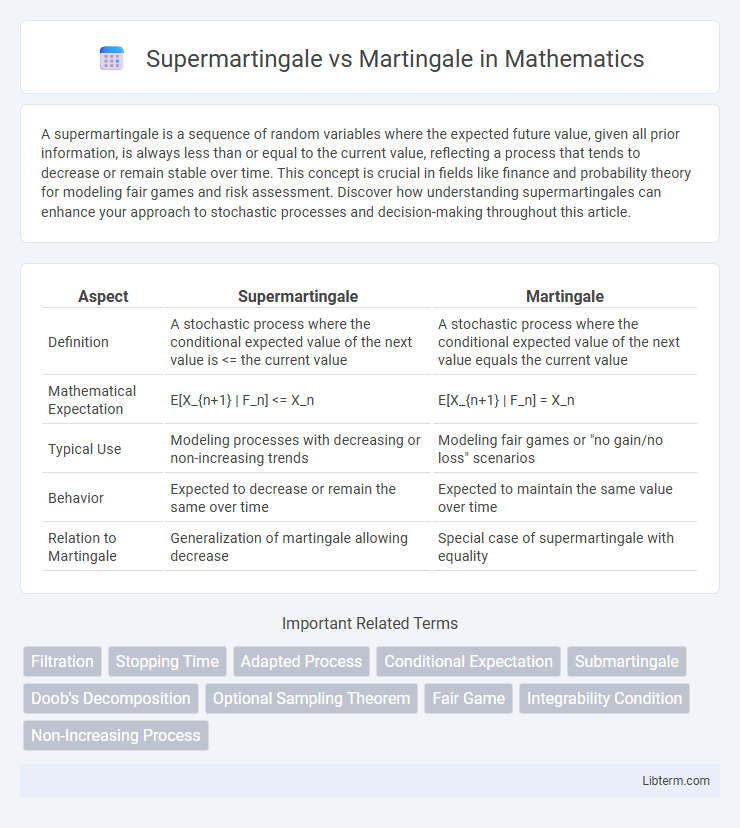

| Aspect | Supermartingale | Martingale |

|---|---|---|

| Definition | A stochastic process where the conditional expected value of the next value is <= the current value | A stochastic process where the conditional expected value of the next value equals the current value |

| Mathematical Expectation | E[X_{n+1} | F_n] <= X_n | E[X_{n+1} | F_n] = X_n |

| Typical Use | Modeling processes with decreasing or non-increasing trends | Modeling fair games or "no gain/no loss" scenarios |

| Behavior | Expected to decrease or remain the same over time | Expected to maintain the same value over time |

| Relation to Martingale | Generalization of martingale allowing decrease | Special case of supermartingale with equality |

Introduction to Martingales and Supermartingales

Martingales are stochastic processes where the conditional expectation of the next value, given all past values, equals the present value, modeling "fair game" scenarios in probability theory. Supermartingales extend this concept by having the conditional expectation of the next value less than or equal to the present value, representing processes with a non-increasing trend on average. Both frameworks are fundamental in the study of stochastic processes, financial modeling, and optimal stopping theory.

Fundamental Concepts: Probability and Stochastic Processes

Supermartingale and Martingale are fundamental concepts in probability theory and stochastic processes, characterizing different types of random sequences based on conditional expectations. A Martingale represents a fair game where the expected future value, given all past information, equals the present value, while a Supermartingale models a process with an expected non-increasing conditional value, often associated with a subfair or losing scenario. These concepts underpin advanced probabilistic modeling in finance, gambling theory, and stochastic calculus, establishing crucial frameworks for analyzing random dynamics over time.

Defining Martingales: Key Properties

Martingales are stochastic processes characterized by the property that the conditional expectation of the next value, given all prior values, equals the current value, reflecting a fair game in probability theory. Key properties include the preservation of the expected value over time and the lack of predictable trends, ensuring no winning strategy with guaranteed profits. Supermartingales extend this concept by allowing the expected next value to be less than or equal to the current value, representing processes with a non-increasing expected trend.

Supermartingales Explained: Core Characteristics

Supermartingales are stochastic processes where the expected future value, conditional on the present, is always less than or equal to the current value, reflecting a non-increasing trend in expectation. Unlike martingales, which have constant conditional expectation, supermartingales embody potential negative drift or loss over time, commonly applied in financial modeling and risk assessment. Key properties include adaptability to a filtration, integrability, and the supermartingale inequality, ensuring expected values do not increase as the process evolves.

Mathematical Differences: Martingale vs Supermartingale

A martingale is a stochastic process where the conditional expected value of the next observation, given all prior observations, equals the current observation, representing a "fair game" with no expected gain or loss. In contrast, a supermartingale is characterized by the conditional expected value of the next observation being less than or equal to the current value, reflecting a process with a non-increasing trend in expectation. Mathematically, if {X_n} is a filtration-adapted process, then for a martingale E[X_{n+1}|F_n] = X_n, while for a supermartingale E[X_{n+1}|F_n] <= X_n almost surely.

Real-World Examples in Finance and Gambling

Supermartingale techniques model asset prices or betting strategies with a downward drift, commonly seen in risk-averse investment portfolios where expected returns are non-increasing, reflecting conservative financial behaviors. Martingale strategies assume fair game conditions, often applied in gambling systems like the classic doubling bet, where the expected value remains constant over time, but practical examples show increasing risk of ruin in real markets. Financial risk management uses supermartingale properties to assess the likelihood of portfolio drawdowns, while gamblers exploiting martingale systems frequently face exponential losses due to betting limits and bankroll constraints.

Conditions and Assumptions for Each Process

Martingale processes assume conditional expectation of the next value equals the current value given all prior information, requiring integrability and fairness in the underlying stochastic system. Supermartingales relax this condition by requiring the conditional expectation of the next value to be less than or equal to the current value, reflecting a non-increasing trend in expected value over time. Both processes depend on filtrations representing the growth of information, but supermartingales allow for downward drift, modeling systems where expected values decrease or remain stable under uncertainty.

Applications in Risk Management and Prediction

Supermartingale models are essential in risk management for identifying and controlling downside risk through expected value decreases, making them suitable for conservative financial strategies. Martingales, characterized by fair game properties with no expected gain or loss, are widely applied in prediction algorithms, such as option pricing and stochastic process forecasting, ensuring unbiased estimations. Both frameworks are instrumental in quantitative finance for optimizing portfolio risk and enhancing predictive accuracy in uncertain environments.

Advantages and Limitations of Martingales and Supermartingales

Martingales ensure fair game conditions with expected future values equal to the present, providing a strong framework for modeling fair stochastic processes but are limited by their inability to model scenarios with trends or drift. Supermartingales, characterized by non-increasing expected values, offer advantages in risk management and modeling decreasing asset prices or ruin probabilities, yet their conservative nature restricts their applicability in adequately capturing upward trends. Both martingales and supermartingales play crucial roles in financial mathematics and stochastic analysis, but the choice between them depends on whether the modeled process is expected to be fair or to exhibit a downward drift.

Conclusion: Choosing Between Martingales and Supermartingales

Choosing between martingales and supermartingales depends on the underlying stochastic process characteristics and the intended application. Martingales maintain a fair game property with constant expected value, making them suitable for modeling neutral or unbiased systems, while supermartingales exhibit a non-increasing expected value, often representing systems with a downward drift or risk. Understanding these distinctions is crucial for accurately applying these models in financial mathematics, gambling theory, or stochastic control.

Supermartingale Infographic

libterm.com

libterm.com